Most cases of metastatic gastroesophageal junction carcinomas (mGEJ) and gastric cancer are human epidermal growth factor receptor 2 (HER2) negative. While Bristol Myers Squibb’s Opdivo (nivolumab) dominates the first-line therapy landscape for mG/GEJ carcinoma, targeted therapy options for this malignancy remain sparse.

The disease is characterised by a high incidence of chemoresistance when compared to other solid tumours. There has been interest in further developing the first-line treatment options, as subsequent lines of treatment for immunotherapy targeting and chemotherapy will be less effective.

Dual mechanism of action gives agent an edge

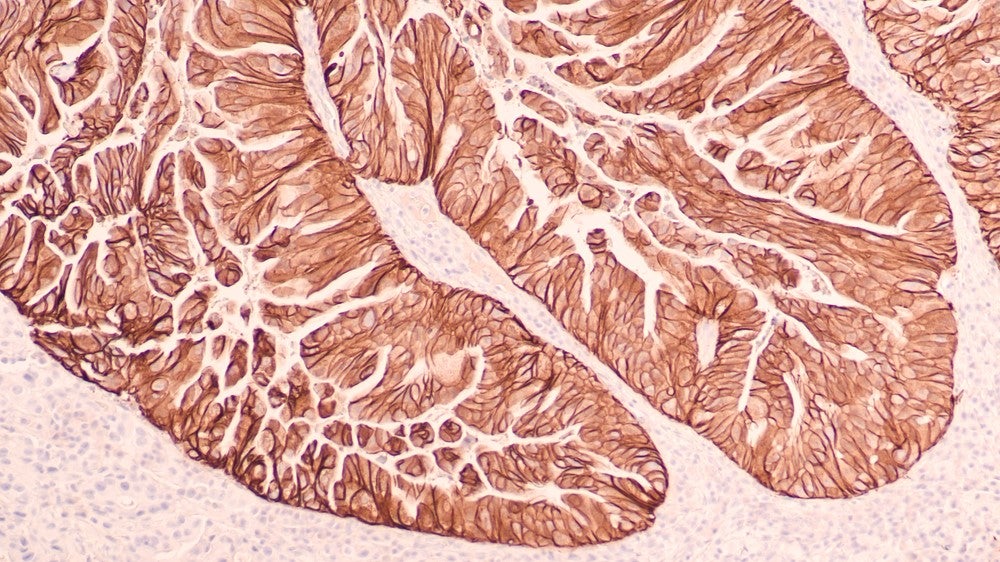

At the European Society for Medical Oncology (ESMO) Congress 2024, held from 13 to 17 September, final data from the Phase III trial (NCT04950322) by Jiangsu Hengrui Pharmaceuticals’ evaluating SHR-1701 were presented. SHR-1701 is a bifunctional fusion protein combining a monoclonal antibody that targets the programmed death cell ligand-1 (PD-L1) and a transforming growth factor-β (TGF-βIIR) binding domain. The agent’s dual mechanism of action is thought to give it an edge in clinical practice. The Phase III trial assessed 731 treatment-naïve unresectable locally advanced or metastatic G/GEJ patients, with one arm (n=365) receiving SHR-1701 in combination with capecitabine and oxaliplatin (CAPOX), while the second arm received placebo in combination with CAPOX (n=366).

The results have been positive, with SHR-1701 demonstrating clear improvements in overall survival (OS) with a median gain in patients with PD-L1 combined positive score (CPS) ≥5. These benefits were also seen in the intention-to-treat group, with an improved median OS of 4.6 months (15.8 vs 11.2 months, p<0.0001) and median progression-free survival (PFS) of 1.5 months (7.0 vs 5.5 months). The safety data also revealed that the addition of SHR-1701 to CAPOX didn’t greatly impact tolerability. There were slightly more Grade ≥3 treatment-related adverse in the SHR-1701 arm (62.6% vs 59.0%), though there were fewer incidences of decreased platelet and neutrophil counts in the SHR-1701 arm.

Taking market share from a trusted therapy?

The first line setting for HER2-negative mGEJ has already seen large-scale prescribing of Bristol Myer Squibb’s Opdivo (nivolumab), the standard of care since 2022. The CheckMate 649 Phase III study demonstrated Opdivo plus CAPOX/FOLFOX regimens significantly improved median OS by 3.3 months (14.4 vs 11.1 months, p<0.0001) when compared to either CAPOX/FOLFOX alone.

It will be an uphill battle for Jiangsu Hengrui Pharmaceuticals to wrestle away market share from an already approved and highly trusted therapy, even if SHR-1701 may provide marginal improvements in the OS endpoint. Outside of SHR-1701, Ganymed Pharmaceuticals’ Vyloy (zolbetuximab), a monoclonal antibody that targets the CLDN18.2 protein highly expressed on cancer cells, had data presented at ESMO on the pooled SPOTLIGHT and GLOW trials. The pooled analysis demonstrated a small, yet statistically significant improvement with the Vyoly + chemotherapy arm in median PFS (1.0 months, p<0.0001) and median OS (2.7 months, p=0.0002) when compared to its placebo plus chemotherapy arm. Despite the significant performance improvement, the gain in efficacy was more impressive with SHR-1701.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData predicts SHR-1701 has a 39% chance of receiving approval in this indication. If granted Chinese and FDA market approval, the company will have to strongly leverage pricing opportunities and its potentially more palatable safety profile to make headway in this market.