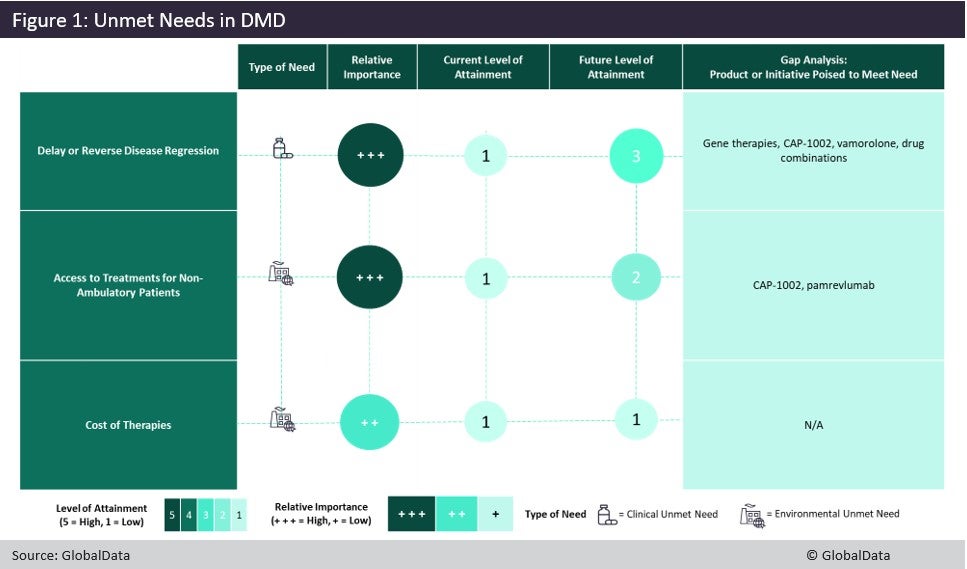

Duchenne muscular dystrophy (DMD) is a severe, progressive muscle-degenerating disease and the most common form of muscular dystrophy. The DMD market has great unmet needs and promising candidates in the pipeline. Currently, patients have limited treatment options with relatively poor safety and efficacy profiles. DMD patients are also currently facing a lack of therapies that effectively delay or reverse disease progression, access to treatments for non-ambulatory patients, and the high cost of marketed therapies. Figure 1 illustrates the importance of these unmet needs, the level at which they are currently addressed and to what degree they are expected to be attained by late-stage pipeline agents in the next decade.

Current available treatments have displayed the ability to delay a loss of ambulation and the decline of heart and lung function. However, they do not stop disease progression or improve patients’ health status. Novel pipeline treatments may either provide better safety and tolerability profiles over the standard of care (such as Santhera’s synthetic steroid vamorolone) or improve efficacy over the current standard of care (with either gene therapies or treatment combinations). Additionally, Capricor’s cell therapy CAP-1002 is specifically targeting cardiac function in non-ambulatory patients, which is a key health concern for this patient group.

Currently, loss of ambulation leads physicians to discontinue exon-skipping therapy for patients with amenable mutations, leaving steroids as the only treatment option for this patient subset. The lack of treatment options for these patients creates an opportunity for pipeline agents such as FibroGen’s pamrevlumab and CAP-1002. If approved, these products could be useful as monotherapies or add-on therapies that can help reduce steroid dosage, and thus also reduce side effects. However, with the exception of pamrevlumab and CAP-1002, which are being studied in both ambulatory and non-ambulatory patients, most pipeline candidates are expected to initially be administered only to ambulatory patients until long-term safety data is acquired.

Aside from highly genericised prednisone, therapies targeting DMD are very expensive, with exon-skipping products costing about $1m per patient annually (depending on weight) and Emflaza, a second-generation steroid agent, costing approximately $175,000 to $275,000 a year. Additionally, the much-anticipated gene therapies that are currently in Phase III are estimated to cost around $2m per patient annually, while other candidates’ prices will have an annual cost of therapy between that of Emflaza (deflazacort) and exon-skipping products.

DMD is a dynamic space with significant unmet needs that GlobalData expects will be partially addressed by drugs that are currently in development. Even though current pipeline products may have better efficacy and tolerability profiles, non-ambulatory patients are still expected to have limited treatment options and the cost of therapy is not expected to reduce due to the rarity of the disease. These trends imply that there is still ample space for novel products to enter the market either as monotherapies or add-on therapies that can be administered in various combinations according to each patient’s needs.

Cell & Gene Therapy Coverage on Clinical Trials Arena supported by Cytiva.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEditorial content is independently produced and follows the highest standards of journalistic integrity. Topic sponsors are not involved in the creation of editorial content.