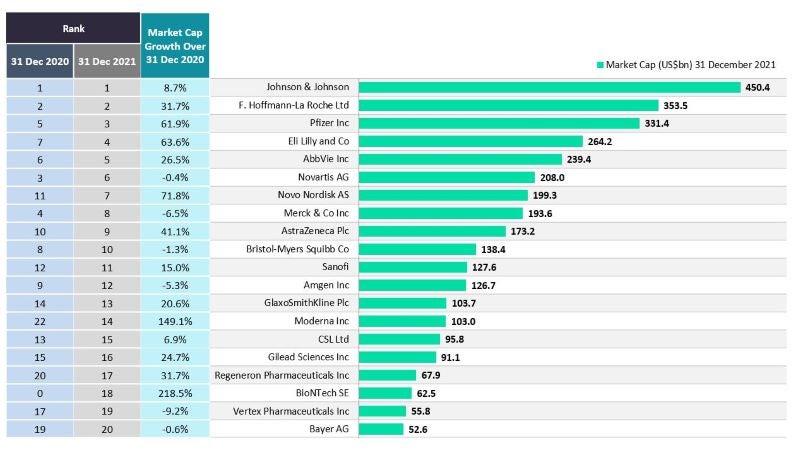

The majority of the top 20 global innovative biopharmaceutical companies have been unscathed by the Covid-19 pandemic, as those with vaccines or therapies for Covid-19 enjoyed a favourable year in 2021. An overall 24.9% growth in aggregate market cap was reported, from $2.8 trillion on 31 December 2020, to $3.4 trillion on 31 December 2021. This led to a positive market cap growth from 2020 to 2021 for 14 of the top players, with five companies demonstrating more than 50% growth in market cap: BioNTech (218.5%), Moderna (149.1%), Novo Nordisk (71.8%), Eli Lilly, and (63.6%) and Pfizer (61.9%).

BioNTech’s market cap for the year ended on 31 December 2021 and grew from $19.6 billion, to $62.5 billion due to the success of its Covid-19 vaccine, Comirnaty, which the company markets with Pfizer. Comirnaty is currently the leading prophylactic vaccine, with an analyst consensus global sales forecast of $55.5 billion for 2021, according to GlobalData’s Drugs Database Pharma Intelligence Centre. Moderna’s share price grew from $104.5 on 31 December 2020, to $253.9 on 31 December 2021, as a result of the sale of its Covid-19 Vaccine (mRNA-1273), with an analyst consensus global sales forecast of $14.2 billion for 2021, according to GlobalData’s Drugs Database Pharma Intelligence Centre. Moderna’s late-stage pipeline also includes its mRNA-2416 and personalised mRNA-4157 vaccines, both of which are in Phase II for oncology indications.

According to GlobalData’s Covid-19 Sector Forecast: Q4 2021 Global Analyst Consensus Sales Forecast report, Comirnaty has taken the majority of the Covid-19 vaccine market taken away from Johnson & Johnson’s Covid-19 vaccine, which saw less than 10% growth in market cap from 2020 to 2021. Increased demand for Moderna’s vaccines may boost its future stock, with the UK, Mexico, Switzerland, and South Korea purchasing additional doses for delivery in 2022. Moderna and Pfizer both reported positive preliminary data for their Covid-19 vaccines, showing an increase of neutralising antibody titers against the Omicron variant.

Novo Nordisk reported a significant increase in its market cap during the same period, due to sales of its diabetes and obesity drugs, including Ozempic (semaglutide). Ozempic is in development for non-alcoholic fatty liver disease, as well as patients with heart failure and obesity, and has proven to have uses across multiple indications in the cardiovascular and metabolic disorder space. Continued strong sales are expected for the therapy, with its approval for the aforementioned diseases being anticipated.

Eli Lilly also showed a strong stock market performance in 2021, with its share price growing from $168.8 on 31 December 2020, to $276.2 on 31 December 2021, due to the sales of its Covid-19 monoclonal antibody-based combination therapy, bamlanivimab + etesevimab, and its investigational antibody therapy, donanemab, which received Breakthrough Therapy designation for Alzheimer’s disease from the FDA due to its Phase II data presenting slow disease progression. However, this strong stock market performance may be short-lived, since the FDA halted the authorisation of Eli Lilly’s Covid-19 treatment in the US on 24 January 2021, citing an unlikely effect against the Omicron variant. Furthermore, the company withdrew its European Medicines Agency (EMA) rolling review process in November 2021. Pfizer’s share price similarly soared in 2021 driven by its Covid-19 franchise.

Vertex Pharmaceuticals was one of the six biopharmaceutical companies that experienced a decline in market cap, with a 9.2% decrease in market cap from 2020 to 2021. This was due to the termination of the Phase II trial of VX-814, which was indicated for alpha-1 antitrypsin deficiency, and was discontinued due to safety and pharmacokinetic profile concerns.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOverall, the majority of the biopharmaceutical companies maintained their ranking in 2020 and 2021, but BioNTech and Moderna were the new entrants in the 2021 list. Johnson & Johnson retained its top position, followed by Roche and then Pfizer, which moved up the list by two places. Vertex Pharmaceuticals dropped two places to 19th place, with Regeneron Pharmaceuticals climbing three places to 17th place. Regeneron Pharmaceuticals’s steady ascent can be attributed to the company’s Covid-19 antibody combination therapy, REGEN-COV, which was approved for market in Q3 2021. However, due to concerns about the diminished potency of REGEN-COV against the Omicron variant, its future success is uncertain.

The top biopharmaceutical companies that developed effective vaccines for Covid-19, rallying during the pandemic to satisfy the market demand, reaped success in 2021. It is likely that Pfizer’s market cap growth will endure, with countries seeking to fulfil their vaccination roll-outs across their populations. Additionally, Pfizer received a pre-order from the US government for 10 million doses of its Phase III small molecule Covid-19 drug, Paxlovid (PF-07321332), as concerns of a possible link to venous thromboembolism sidelined the use of Covid-19 vaccines from Johnson & Johnson.

The speed of development and approval of innovative messenger ribonucleic acid (mRNA) vaccines for Covid-19 may pave the way for potential further development of these technologies for vaccines, or therapies for other therapeutic areas in the future.