The US Food and Drug Administration’s (FDA) accelerated approval scheme is responsible for the swift entry into the clinic of revolutionary drugs such as Novartis’ Gleevec (imatinib) in chronic myeloid leukaemia. Maintaining such approvals is contingent upon confirmatory studies that support continued benefit in patients. As such, a minority of accelerated approvals have ended up being withdrawn when the treatment did not lead to benefit in the confirmatory trials.

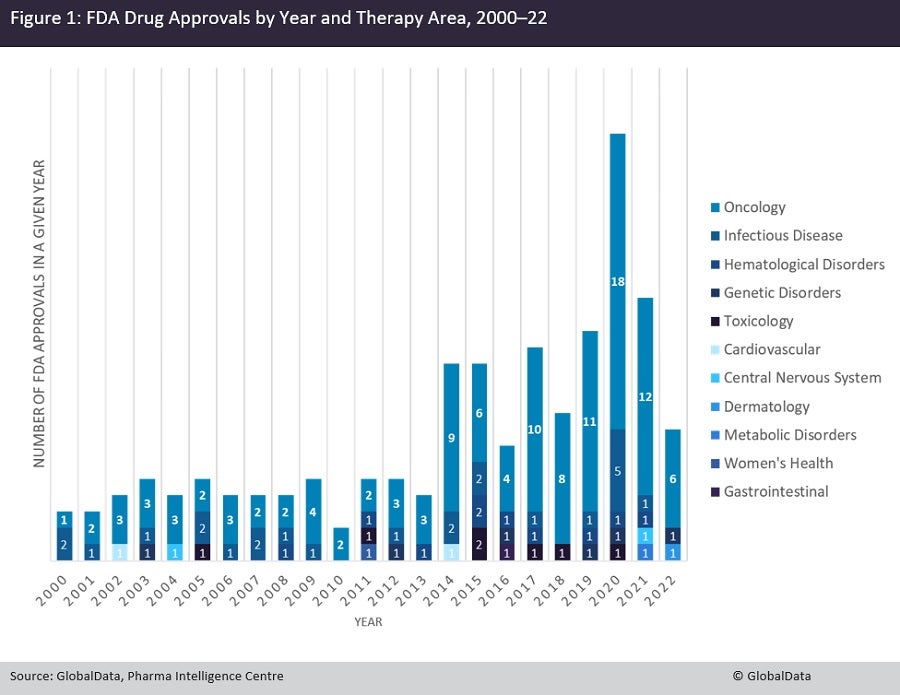

An analysis of GlobalData’s Pharma Intelligence Centre shows that oncology drugs account for 66% of all FDA accelerated approvals since 2000, with 88 distinct drugs gaining such approval. Oncology is followed by infectious diseases at 15%, with 20 approved drugs, and haematological disorders at 5%, with seven approved drugs (Figure 1). This large difference is very likely multi-factorial. Firstly, oncology has the highest number of drugs in development, meaning more of them will have been designated under the scheme; secondly, most oncology indications intrinsically have an extremely high level of unmet need, supporting the need for swift approvals of effective drugs; and lastly, in many instances in oncology, Phase II trials can yield response rate readouts quickly that can be then used as a basis for accelerated approval.

An analysis by molecule types shows that the majority of oncology drugs were small molecule inhibitors, at 63%, with 55 drugs approved, followed by monoclonal antibodies (mAbs) at 22% with 19 drugs approved, and antibody-drug conjugates (ADCs) at 10%, with nine drugs approved. In addition to the naturally higher frequency of small-molecule drugs, they are also overrepresented due to the existence of biomarker-driven trials; many cancer types provide fertile ground for targeted kinase inhibitors, such as Pfizer’s Xalkori (crizotinib) in EML-ALK-driven non-small cell lung cancer (NSCLC), that are accompanied by a biomarker test and form the foundation of personalised oncology. ADCs and mAbs, while also able to target such alterations, do not have the versatility of small molecule inhibitors.

In terms of cancer indications, NSCLC eclipses all other cancers with 17 drugs, followed by metastatic bladder/urothelial cancer (mUC) with eight drugs, and various solid tumours (tumour-agnostic labels) with seven drugs. While NSCLC is the poster child of personalised oncology and prudent accelerated approvals, mUC has been less successful, with at least two labels for accelerated approval of immune checkpoint inhibitors withdrawn. Patients with various solid tumours and defined biomarkers such as BRAF V600E, mismatch-repair deficiency, or high tumour mutational burden have also benefited from the accelerated approval program as it has allowed them to be matched to personalised drugs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData