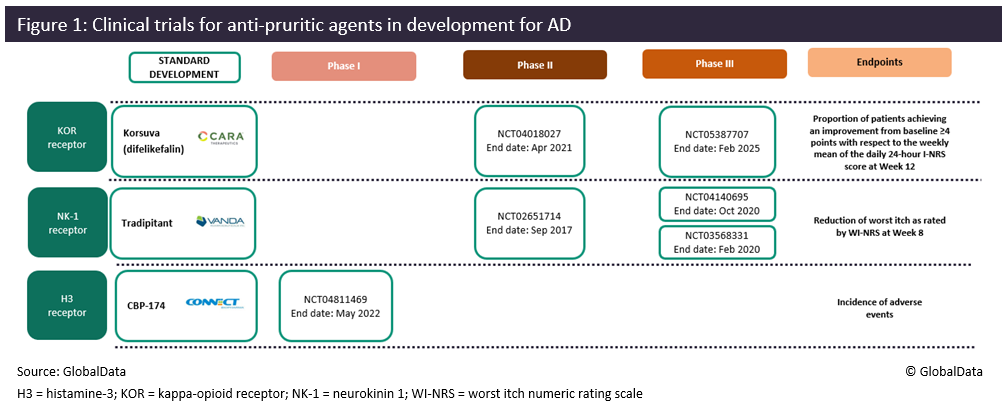

Anti-itch agents are becoming more prominent in the atopic dermatitis (AD) therapeutic space with multiple new product candidates in the early and late-stage pipeline. Itch is an integral symptom in AD and arguably one of the most intolerable, affecting all patients regardless of age and disease severity. Pruritus is currently managed using a range of topical and systemic treatments such as topical corticosteroids (TCS), immunomodulators, and biologics, but none of these agents have been able to completely eradicate the symptomatic feeling of itch. Figure 1 highlights three systemic anti-pruritic products currently in clinical development for the treatment of AD, including key clinical trials and trial endpoints.

In the realm of anti-itch agents, Cara Therapeutics is hoping to enter the AD space with its oral kappa-opioid receptor (KOR) agonist, difelikefalin, which is already marketed in an intravenous formulation, known as Korsuva, for the treatment of moderate to severe pruritus associated with chronic kidney disease in adults undergoing hemodialysis. In October 2021, Cara presented data from difelikefalin’s Phase II (NCT04018027) KARE study at the European Academy of Dermatology and Venereology (EADV) 2021 demonstrating significant itch reduction in mild to moderate AD patients with severe itch as early as day 2. Although the KARE study did not meet the primary endpoint of worst itch numerical rating scale (WI-NRS) change from baseline at week 12 in the intention-to-treat (ITT) patient population, the study did achieve the primary endpoint in a pre-specified analyses of mild to moderate AD patients (64% of the ITT patient population). Cara has since launched a Phase III trial, KIND-1 (NCT05387707), to evaluate the efficacy and safety of oral difelikefalin as an adjunct therapy to TCS for moderate to severe pruritus in adult subjects with AD. The company aims to leverage data from this study to support first-line positioning of its oral anti-pruritic along with standard of care TCS in adults with moderate to severe pruritus. GlobalData anticipates that difelikefalin will enter the US market in Q1 2026.

Difelikefalin’s closest competitor is Vanda Pharma’s neurokinin-1 (NK-1)-receptor antagonist tradipitant, which has already been investigated as a monotherapy in two Phase III trials, EPIONE (NCT03568331) & EPIONE2 (NCT04140695). Despite this, tradipitant failed to meet the primary endpoint of reduction of WI-NRS change in EPIONE, which triggered the commencement of the identical EPIONE2 study that further assesses tradipitant’s anti-pruritic effects in the mild to moderate AD patient group. EPIONE2 was on hold due to the COVID-19 pandemic but was recently marked as completed with a substantial reduction in enrollment from 200 to 80 participants. As this trial would have been pivotal for regulatory submissions, the likelihood that Vanda Pharma will initiate regulatory submissions for tradipitant is uncertain and it may be possible that another Phase III program trialing the product in combination with TCS may be needed, similar to Cara’s Phase III KIND-1 trial for difelikefalin. GlobalData anticipates that tradipitant will enter the US market in Q1 2024, two years before Cara’s difelikefalin, which will likely give it a competitive advantage.

The final anti-pruritic agent is CBP-174, a peripherally acting histamine 3 receptor antagonist, which is being developed by Connect BioPharma. So far the product has been investigated in a Phase I (NCT04811469) trial. The company has yet to release any safety and efficacy data, but the product utilizes a unique mechanism of action, which may garner some interest as the AD pipeline continues to grow and differentiate.

The anticipated introduction of these anti-itch drugs will be advantageous for patients as it will diversify treatment options for those patients who have yet to alleviate their pruritus with existing therapies. Key opinion leaders interviewed by GlobalData have noted that these agents have interesting mechanisms of action, but that pivotal data is required to form solid conclusions on their potential.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData