Disruption is a pressing problem in the pharmaceutical world; patient health depends on the smooth and predictable movement of resources from A to B. Challenges have reached new heights in recent years. The global race to accelerate Covid-19 vaccine trials and production laid bare some of the sector’s vulnerabilities. Lockdowns, labour shortages, and disrupted raw material supplies left lasting impacts. Recent economic turbulence, stemming from high inflation and geopolitical instability, has compounded existing pressures.

GlobalData’s Company Filings Analytics report for Q1 2024 highlights how these challenges are weighing on the minds of industry leaders. Supply chain disruptions were ranked as one of the top four concerns in recent reports. They were considered twice as pressing as competitive market pressures. Legal, regulatory and macroeconomic risks complete the ranking. Pharma executives are acutely aware of the need to address bottlenecks to safeguard both drug development and availability.

Populations are ageing and increased mobility is catalysing disease outbreaks. A robust clinical trial infrastructure, capable of developing therapies that will solve the medical challenges of the future, is vital. But in an era of pharmaceutical disruption, the road for getting clinical trials from initiation to completion is rockier than ever. Understanding what the roadblocks are, where they are occurring and the kinds of therapies that are most vulnerable can provide practitioners with critical insights on how to navigate disruption.

A landscape of disruption

The landscape of clinical trial disruption is a complex one. No two trials are exactly the same. Myriad geographical, financial, strategic and completely unforeseen circumstances can force trial organisers to rethink or abandon their plans. Analysis of GlobalData’s Clinical Trials database, a repository of information on over 400,000 active and recently disrupted trials, sheds light on what some of the key trends are.

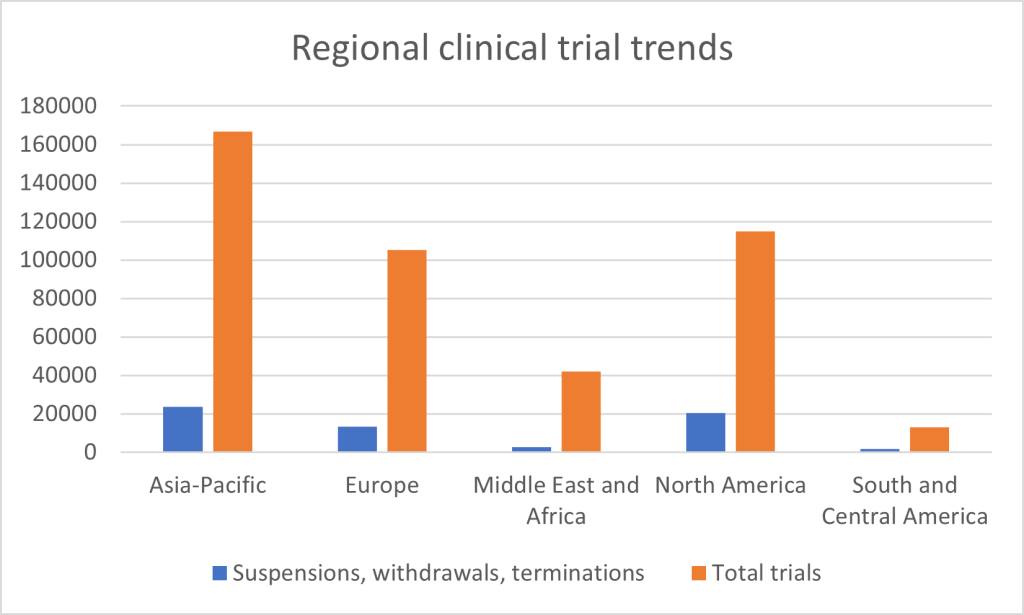

First, geographical circumstances. Regionally, the rate of clinical trial suspensions, withdrawals, and terminations varies. The Asia-Pacific region has the highest absolute number of disruptions—23,764 trials out of 166,905, or approximately 14.2%. North America follows closely, with 20,327 disruptions out of 114,750 trials, reflecting a disruption rate of 17.7%. In Europe, 13,203 trials were disrupted out of 105,214 – its rate of 12.5% a relatively stable one in comparison to other regions. The Middle East and Africa, while conducting fewer trials overall, had 2,759 disruptions out of 41,928 trials, or around 6.6%. Lastly, South and Central America experienced the lowest number of disruptions, with 1,844 trials affected out of 13,192, resulting in a disruption rate of 14%. The North American and Asia-Pacific regions are responsible for by far the highest overall numbers due to their substantial involvement in global clinical research. Disruptions in the Middle East and Africa are relatively muted, while Europe compares favourably in terms of proportions.

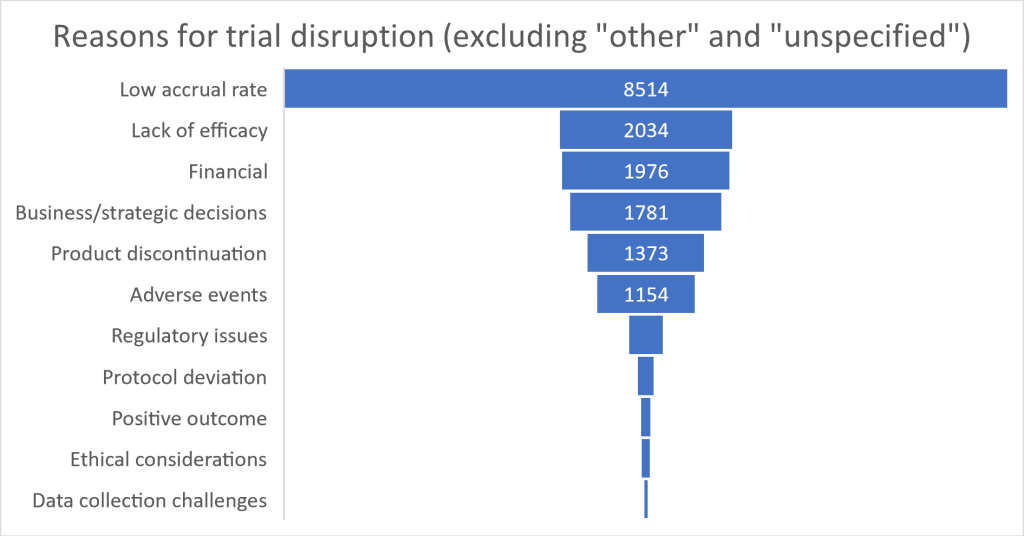

Clearly there are substantial differences in clinical trial disruption from place to place. But what are the key reasons cited for these disruptions? The factors behind a large proportion of terminations remain opaque, with 11,702 attributed to “other” reasons and 34,659 left unspecified; many disruptions may involve unique, poorly documented or case-specific complexities. For those trials where disruption data is available, participant recruitment leads the pack, with 8,514 trials halted due to low accrual rates. Efficacy issues and financial constraints represented approximately the same sized barriers to trials, responsible for around 2,000 disruptions each. Business and strategic decisions accounted for 1,781 terminations. Product discontinuation and adverse events, which affected 1,373 and 1,154 trials respectively, reflect the complex commercial and safety concerns in clinical development. Other factors like regulatory issues (403 trials), protocol deviations (193 trials), and ethical considerations (105 trials) were less common but still significant in determining whether a trial would be concluded successfully on time or at all.

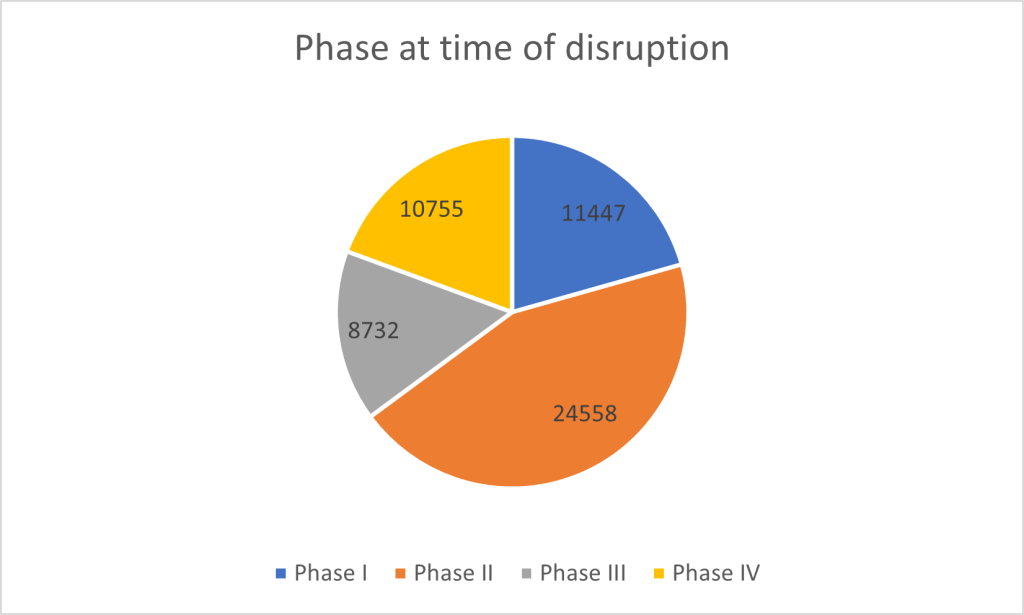

Disruptions in clinical trials occur across all phases of development. Phase II trials are the most frequently affected. A considerable 24,558 trials were disrupted during this intermediate phase. Phase I trials, which focus on safety and dosing in small patient groups, saw 11,447 trials disrupted, reflecting early-stage hurdles in clinical research such as issues related to safety or viability. Phase IV trials, which occur after a drug has been approved and are intended to monitor long-term effects in the broader population, experienced 10,755 disruptions. Even after approval, significant hurdles clearly remain in post-market surveillance. Finally, 8,732 Phase III trials—often the largest and most expensive, designed to confirm efficacy in large populations—were halted, underscoring the high financial and logistical stakes as drugs approach potential market approval.

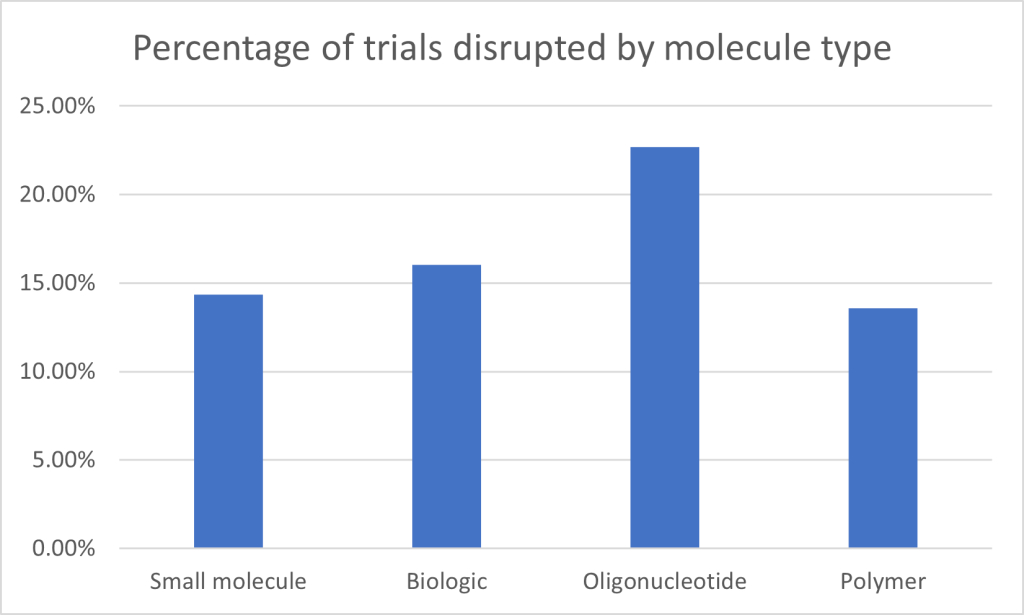

Looking at clinical trial disruptions by molecule type, small molecules account for the highest number of affected trials, with 45,042 trials disrupted. However, with small molecule trials by far the highest in number overall throughout the database – a whopping 313,672 – this represents a relatively modest 14.35% of the total. Biologics, which include therapies such as antibodies and vaccines, saw a slightly higher disruption rate, with 16.03% of the total 118,874 trials disrupted (19,066 trials). Oligonucleotide trials have the highest disruption rate at 22.7%, with 514 trials disrupted out of 2,264. Finally, polymer-based therapies, although the smallest category in terms of total trials, saw a disruption rate of 13.57%, with 123 trials disrupted out of 907. The figures highlight that, while small molecules and biologics dominate in terms of absolute numbers, novel and experimental therapies clearly face proportionally greater disruption.

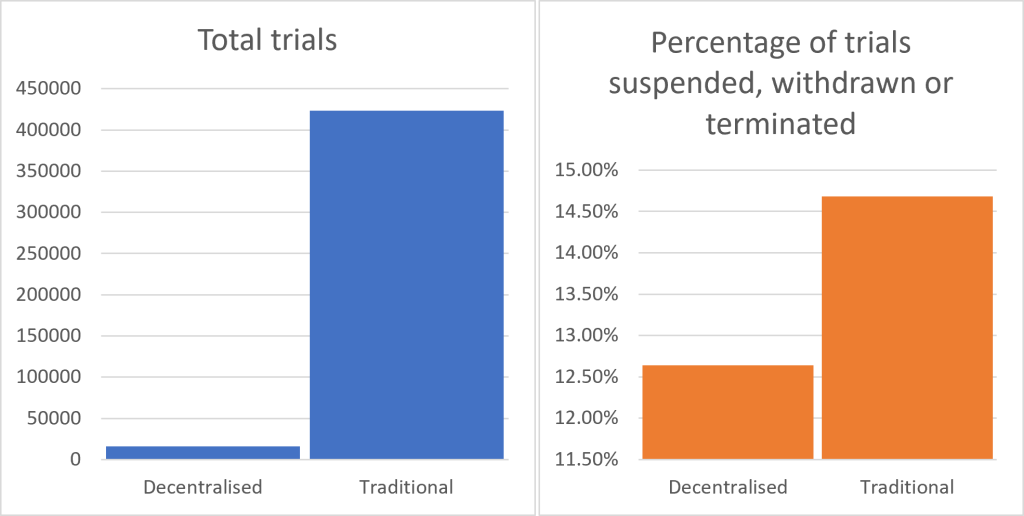

One response to recent clinical trial supply chain challenges has been to boost the prevalence of decentralised trials. Drawing on wearable technology and remote surveillance, they are increasingly being utilised to circumvent some of the logistical issues confronting clinical trials. When comparing decentralised and traditional clinical trials, the data suggests that decentralised trials are indeed slightly less likely to be disrupted as a percentage of the total. Out of 15,711 decentralised trials, 1,986 were suspended, withdrawn, or terminated, equating to approximately 12.6%. In contrast, traditional trials, which involve in-person participation at clinical sites, saw 62,158 disruptions out of 423,373 trials, or around 14.7%. While the absolute number of disruptions is much higher for traditional trials, divergent performance could act as a bellwether for future trial planning; the momentum is clearly on the side of decentralisation.

Navigating disruption

The pharmaceutical industry is grappling with ongoing challenges to clinical trial viability. As it does so, new solutions are emerging to address the complexities involved in running a clinical trial – whatever phase they have reached, whatever points in their supply chains are most affected. Among these is Controlant’s Aurora Platform. Offering real-time tracking, predictive analytics and automation capabilities to streamline supply chain operations, it represents an all-encompassing tool that clinical trial trailblazers can deploy to crack down on disruptions and optimise their operations.

When temperature-sensitive drugs for clinical trials are transported between warehouses, distribution hubs, and clinical sites such as hospitals, real-time monitoring helps maintain the quality and safety of the drugs. Using real-time data from Controlant’s IoT devices, the Aurora Platform enables users to prevent or investigate a temperature excursion before the drug arrives at its destination. Irrespective of how centralized or decentralized a clinical trial is, benefits of this proactive response capability include a reduction in out-of-window visits, protocol deviations, participant dropout rates, and product loss. It also reduces the burden on the sites to report to pharma and manage the knock-on effects of quarantining IMP, re-scheduling clinics, and so on.

Another key advantage is the valuable process automation that this real-time shipment monitoring unlocks along the supply chain. For example, if status reports are automated, pharmacists don’t need to go through and mark it all off, line by line. This speeds up the process, reduces the load on pharmacists, and frees up time for more value-adding tasks.

Real-time visibility and analytics are not just about efficiency – they also offer greater flexibility, enabling companies to respond to disruptions quickly and effectively. According to some recent analysis, 58% of pharma suppliers lack full visibility over their supply chains. Platforms like Aurora provide the crucial oversight needed to meet regulatory standards, sustainability goals and smooth out supply chain kinks – all while ensuring clinical trials can continue to run smoothly.

The pace of digital disruption in the pharmaceutical world can seem disorientating. But pharma leaders should deploy tools that allow them to ride the wave of disruption and extract the positives – not get bogged down in the difficulties, with knock on effects for trial processes. Solutions like Controlant’s Aurora are already revolutionising how pharmaceutical firms manage supply chains. With enhanced automation, real-time insights and reduced reliance on manual processes, companies are better equipped than ever to work through the complexities of clinical trials and bring products to market faster. Download the whitepaper on this page to learn more.