There are over 300 glucagon-like peptide-1 receptor (GLP-1R) drugs in an active stage of development as the astounding success of Novo Nordisk’s GLP-1R obesity drug, Wegovy, has ignited a surge in innovator drug obesity trials. Companies are hoping to disrupt the space and loosen the stronghold that Novo Nordisk and Eli Lily, whose obesity drugs accounted for 99% of the $37.2bn GLP-1R sales in 2023, have on the market.

The popularity of GLP-1R drugs has catapulted the treatment landscape of obesity into the spotlight. Reformation for the management of this disease is long overdue considering obesity was only recognised as a disease by the American Medical

Association in 2013, despite affecting around 74% of the US population, according to the National Institutes of Health. This reinforces the World Health Organization’s assessment of obesity as one of the most visible – yet most neglected – public health problems. However, the tide fortunately appears to be shifting thanks to the success of several high-profile GLP-1R drugs in recent years.

A critical part of this reformation is providing effective, innovative, and accessible treatments, which the industry is currently excelling at. According to leading data and analytics company GlobalData’s Trials Intelligence platform, 2024 was a record year for obesity clinical trials, with the number of trials increasing year-on-year since 2020. 2025 appears set to continue this trend with a substantial number of planned trials already announced, not even a full week into the year (Figure 1).

One way that sponsors appear to be keeping up with the growing demand for obesity trials is by utilising decentralised designs and virtual components; data derived from GlobalData’s Trials Intelligence platform indicates that 13% of obesity

trials in 2024 were either decentralised or utilised at least one virtual component such as wearables, sensors, and apps. Utilisation of these technologies enables richer, more granular data collection and can increase patient engagement, as

they often receive real-time updates and progress updates, which sustains motivation, possibly increasing patient recruitment and retention.

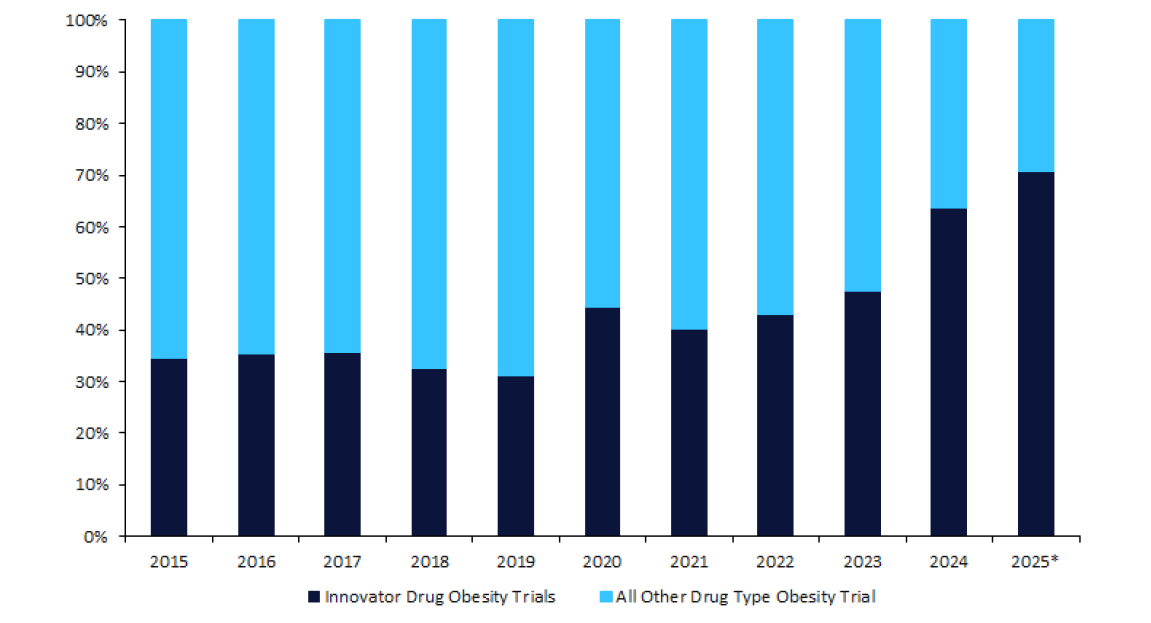

Additionally, GlobalData’s Trials Intelligence platform indicates that the percentage of these obesity trials investigating an innovator drug is increasing year-on-year, with 2024 also marking a momentous shift by being the first year with over half

of trials, specifically 64%, being innovator drug trials. Again, 2025 may break this record, as 71% of the trials already announced are investigating innovator drugs (Figure 1). The market outlook for several of these innovator drugs looks

promising, and GlobalData estimates that a number of these pipeline GLP-1Rs are likely to launch in 2030, subsequently contributing to the whopping $125bn GLP-1R expected sales by 2033, according to GlobalData.

Although treatment is a significant part of supporting positive patient outcomes, gaps in the market remain as opportunities to address other factors. According to a high-prescribers survey conducted by GlobalData, key opinion leaders are calling on national healthcare authorities to provide structured guidelines regarding diagnostic methods and disease management. In terms of diagnostic methods, body mass index is not considered to be accurate in many cases, leaving a need for a more accurate and unified diagnostic criteria. Hopefully, with the newfound spotlight on obesity, the overall disease landscape will undergo reformation to tackle the global obesity epidemic.