AbbVie and Genmab have announced accelerated FDA approval for their bispecific T-cell engager (BiTE) Epkinly (epcoritamab-bysp) for the treatment of relapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL) patients who have received at least two prior lines of systemic therapy. Epkinly engages with CD20 expressed on the surface of B-cells and with CD3 on the surface of T-cells, thereby directing cytotoxic T-cells to CD20-expressing cancer cells.

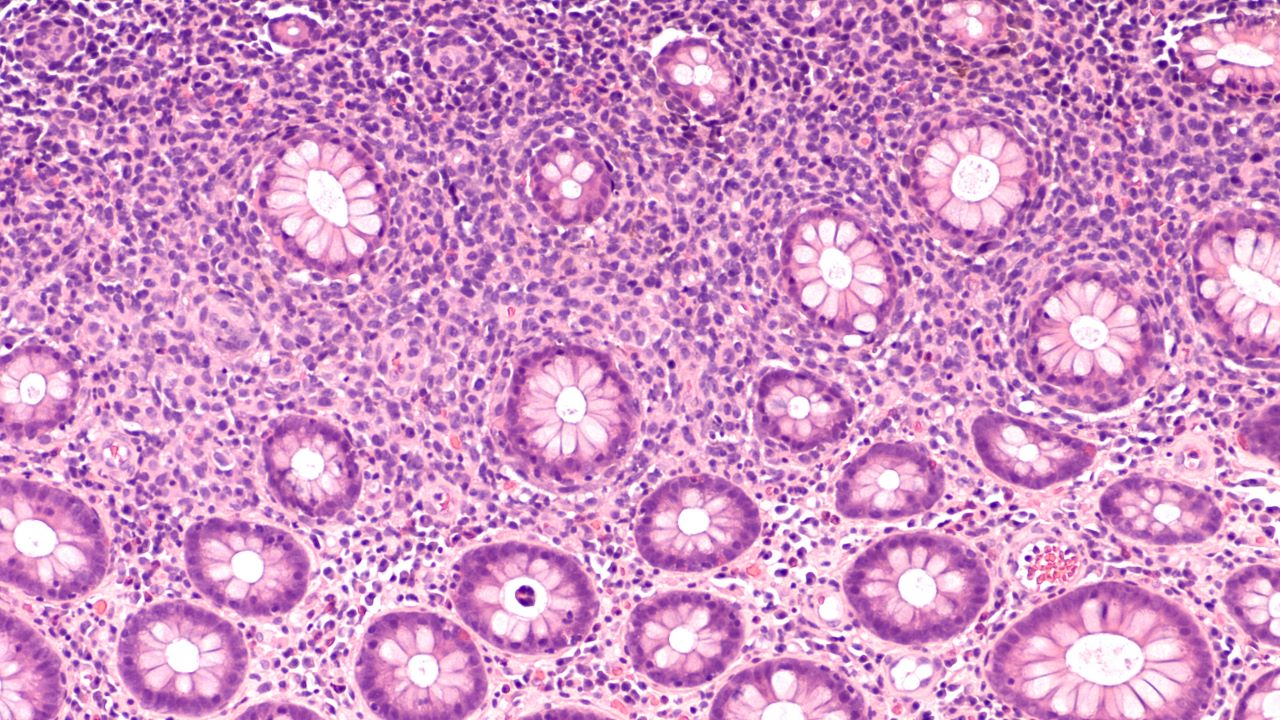

DLBCL is a highly aggressive malignancy and is the most common type of non-Hodgkin lymphoma (NHL) worldwide. In the US alone, there were an estimated 30,400 new DLBCL cases in 2022. The standard of care in the first-line (1L) DLBCL setting for almost two decades has been the chemoimmunotherapy regimen consisting of rituximab, three chemotherapy drugs (cyclophosphamide, doxorubicin, and vincristine), and a glucocorticoid (either prednisone or prednisolone) (R-CHOP). Last month saw a change to the 1L clinical guidelines with the approval of Genentech’s anti-CD79b antibody-drug conjugate Polivy (polatuzumab vedotin) in combination with rituximab, cyclophosphamide, doxorubicin, and prednisone (R-CHP) for patients who have a poorer prognosis at diagnosis, as measured by an International Prognostic Index score of two or greater. While these 1L therapies are curative for a large subset of patients, 30%–40% of patients fail to respond to the initial therapy or relapse within two years. In the second line (2L), treatment options include an autologous stem cell transplant (ASCT), an anti-CD19 chimeric antigen receptor T-cell (CAR-T) therapy (Gilead’s Yescarta (axicabtagene ciloleucel) or BMS’ Breyanzi (lisocabtagene maraleucel)), Polivy or MorphoSys’s Minjuvi (tafasitamab), which is an anti-CD19 monoclonal antibody. Unfortunately, these therapeutic options are not curative for many patients, and a third-line treatment is required.

Epkinly has gained approval based on impressive efficacy data from the Phase I/II EPCORE NHL-1 clinical trial. There were 148 CD20-positive DLBCL patients enrolled in the Phase II expansion cohort. The median number of prior lines of therapy was three, with 18% of patients having received a prior ASCT, and 39% of patients having received a CAR-T therapy. The trial reported an overall response rate (ORR) of 61%, with a complete response rate (CRR) of 38%. The median duration of response was 15.6 months. Response rates in patients without prior CAR-T therapy were better than those with prior exposure to CAR-T therapy, with an ORR of 69% versus 54% and a CRR of 42% versus 34%, respectively. However, these impressive response rates come with toxicity, with almost half of all patients treated developing cytokine release syndrome.

GlobalData’s consensus forecast forecasts that Epkinly will achieve blockbuster status by 2027, with global sales expected to exceed $1.9bn by 2029. Despite Epkinly’s first-to-market advantage over other CD20-targeting BiTEs, it will face competition from same-in-class agents, Genentech’s Lunsumio (mosunetuzumab-axgb) and Regeneron’s odronextamab, both of which are in pivotal trials. AbbVie and Genmab are trying to gain further patient share in the DLBCL setting with ongoing Epkinly trials for 2L patients and elderly 1L patients. Although CAR-T therapies have already changed the outlook for R/R DLBCL patients, the off-the-shelf nature of BiTEs means that effective treatment will become available to a much larger patient population.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData