Syndax Pharmaceuticals and Kura Oncology recently published their fourth-quarter and full-year financial results for 2022. The two biopharmaceutical companies focused on the clinical development progress of their star candidates, revumenib and ziftomenib, respectively. Both of these therapies are menin inhibitors disrupting the same menin-MLL1 interaction, and in a close competition for a share of the acute myeloid leukaemia (AML) therapeutics market.

Syndax is slightly ahead in the race with a forecast topline data readout from revumenib’s Phase I/II pivotal trial (AUGMENT-101) in relapsed/refractory (R/R) AML with mutated NPM1 or KMT2A (or MLL) rearrangement expected in the third quarter of 2023, in addition to a new drug application (NDA) filing for the menin inhibitor expected by the end of the year. Kura did not disclose any predicted filing timeline for ziftomenib in the press release for its year-end result. Further data updates on ziftomenib’s Phase I/II registrational trial (KOMET-001) in NPM1-mutant AML are expected to be released in mid-2023.

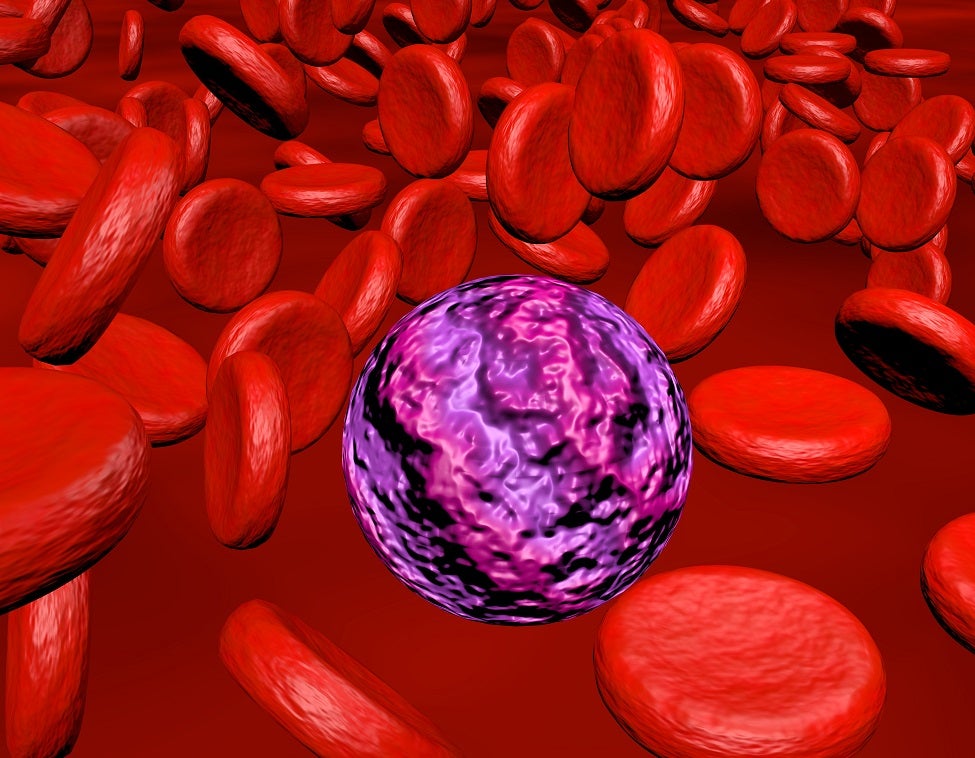

After the launches of FLT3 and IDH1/2 inhibitors over the past decade, menin inhibitors could be the third and latest group of targeted therapies for AML patients. Categorised into different risk groups, different cytogenetic abnormalities in AML patients heavily affect the patient journey in terms of disease prognosis. AML with NPM1 mutation and KMT2A rearrangement (KMT2Ar) is associated with poor prognosis and a higher chance of poor response and relapse. Both mutations appear in the adverse risk category under the European LeukemiaNet (ELN) risk classification for AML.

There is currently a gap in addressing the medical needs of patients carrying these mutations, since there is no FDA-approved therapeutic agent targeting such abnormalities. As many as 10–30% of AML patients were estimated to harbour at least one of these germline predispositions. Menin inhibitors exert a therapeutic effect by preventing the binding of the menin protein and KMT2A complex, thus switching off the pathway and promoting the differentiation of leukaemic immature blasts. GlobalData’s Pharma Intelligence Centre (PIC) showed that there are five menin inhibitors in the pipeline that are currently in the clinical stage. In the AML space, the five candidates—Syndax’s revumenib, Kura’s ziftomenib, Sumitomo Pharma’s DSP-5336, Daiichi Sankyo’s DS-1594, and Biomea Fusion’s BMF-21—are mostly gearing towards the R/R setting as monotherapy, with the planning of combination trials with drugs in the standard of care (SOC) underway, such as AbbVie’s/Roche’s Venclexta (venetoclax) and Astellas’ Xospata (gilteritinib).

At the recommended Phase II dose (RP2D) level in their Phase I component, revumenib and ziftomenib demonstrated encouraging efficacy data in terms of complete remission rates (CR/CRh) of about 30% in patients with NPM1 mutations. For patients with KMT2Ar, a higher CR/CRh rate of 27% was observed in revumenib’s AUGMENT-101 trial compared to only 5.6% in ziftomenib’s KOMET-001 trial. More data is still needed to further establish the efficacy of the menin inhibitors for these patient populations in need.

Beyond addressing the unmet medical need, this novel class of small molecule oral inhibitors has further potential in taking up more prominent roles in the AML treatment paradigm through building synergies with current SOC treatments. Several menin inhibitors are being evaluated as a combination therapy with the SOC to allow movement into earlier lines of therapy. DS-1594 is employing a combination therapy approach with its ongoing Phase I/II trial (NCT04752163) where the candidate is administered with Venclexta and azacitidine in one of the R/R AML cohorts. In the meantime, Kura and Syndax have different strategies. The KOMET-007 trial is expected to be launched in the first half of 2023 to evaluate the safety and efficacy of ziftomenib in combination with venetoclax plus azacytidine or the 7+3 chemotherapy regimen, whereas the AUGMENT-102 trial, on revumenib with the less popular AML chemotherapy regimen fludarabine and cytarabine, is actively recruiting.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDespite the promising potential of menin inhibitors, safety challenges remain an area of concern. Differentiation syndrome is a notable treatment-related adverse event (AE) shared by revumenib and ziftomenib in their Phase I trial component. The AE was also observed in the class of IDH1/2 inhibitors, occurring in 14–25% of patients (between 7% and 11% experiencing Grade III or higher) in related trials. While differentiation syndrome occurred in 16% of revumenib recipients (AUGMENT-101), 57.5% of ziftomenib recipients (KOMET-001) had the same AE with 30% of them at Grade III or higher, highlighting a potential yet important safety risk for the class. In addition, irregular heart rhythm was another notable AE, which took place in 53% of revumenib recipients (AUGMENT-101) with 13% at Grade III or higher. More optimised management of these AEs is needed in the future to ensure the well-being of patients after the treatment of menin inhibitors.