On 14 March 2024, the US Food and Drug Administration (FDA) granted accelerated approval to Bristol Myers Squibb’s (BMS) Breyanzi, a CD19-directed chimeric antigen receptor (CAR) T-cell therapy.

The drug treats patients with relapsed or refractory (R/R) chronic lymphocytic leukaemia (CLL) and small lymphocytic lymphoma (SLL), who have received at least two prior therapies, including a Bruton tyrosine kinase (BTK) inhibitor and AbbVie and Genentech’s B-cell lymphoma 2 inhibitor Venclexta.

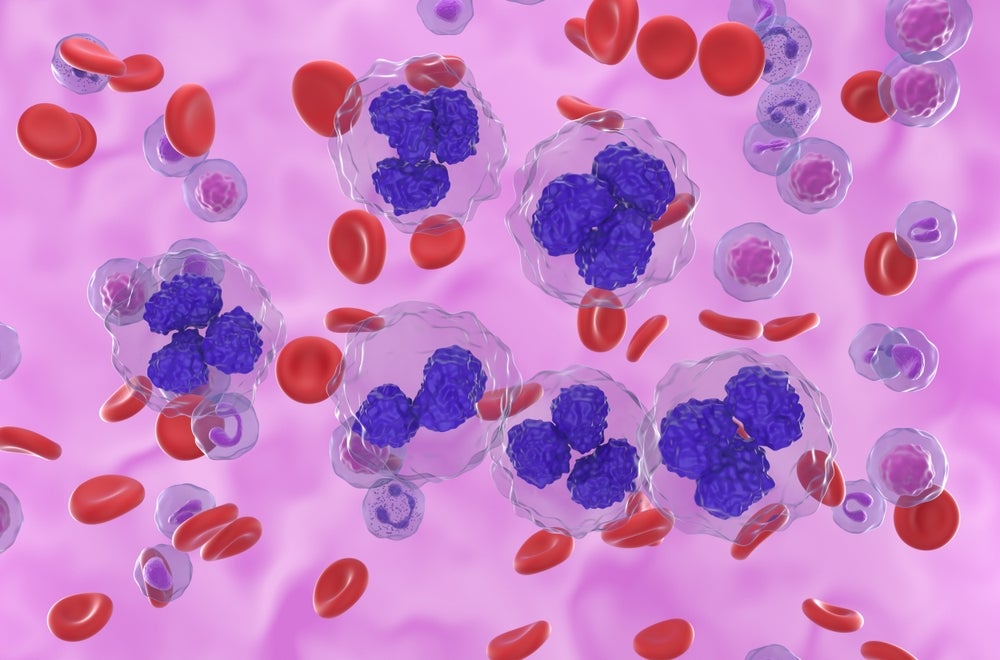

CAR T-cell therapies work by modifying a patient’s T cells to target and eliminate cancer cells through a one-time treatment with potentially long-lasting effects.

This first-ever CAR T-cell therapy with accelerated approval in CLL was based on a pivotal Phase I/II, single-arm, multicentre trial TRANSCEND CLL 004, which included patients with R/R CLL and SLL.

The decision was made based on the deep and durable complete response (CR), a 20% CR and 35.3 months median duration of response among all responders, an efficacy that is uncommon among the current treatment options.

Breyanzi’s approval for the heavily pretreated CLL/SLL patient population brings competition to Eli Lilly’s Jaypirca.

Jaypirca, an oral non-covalent BTK inhibitor, was recently approved as a third or later line of therapy for patients who had not benefitted from previous treatments with BTK and BCL2 inhibitors.

Only 1.6% of patients experienced a CR with Jaypirca.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn addition, Breyanzi, similar to all other CAR-T therapies, offers the convenience of a single-dose infusion but can only be administered at designated treatment centres, and therefore its accessibility will be a significant factor in treatment decision-making.

According to leading data and analytics company GlobalData’s consensus analyst forecast, Breyanzi’s global sales are expected to reach almost $2bn, trailing behind Gilead Sciences’ Yescarta, another CAR T-cell therapy and its closest competitor, with nearly $2.5bn in sales by 2030.

Additionally, BMS awaits the FDA decision on Breyanzi for the treatment of R/R follicular lymphoma and R/R mantle cell lymphoma following BTK inhibitor therapy, and the company has several label expansion trials across various haematologic malignancies, which, if successful, will drive up peak sales of Breyanzi.

The evolving landscape of CAR T-cell therapies includes concerns about long-term safety, particularly the risk of secondary malignancies.

However, the benefits of CAR T-cell therapies, particularly for patients with few other options, significantly outweigh these potential risks.

This approach holds the promise to shift from an ongoing series of treatment regimens to combat drug resistance to a single, personalised T-cell-based therapy delivering a complete or enduring remission to a subset of patients.