With pipeline approvals of varying mechanisms of action and an influx of newly diagnosed patients, the chronic kidney disease (CKD) market is expected to grow at a 19.6% compound annual growth rate from $2.2bn in 2023 to $13.5bn in 2033 in the seven major markets (US, France, Germany, Italy, Spain, UK, and Japan), according to the upcoming GlobalData report: Chronic Kidney Disease: Seven-Market Drug Forecast and Market Analysis.

Leading data and analytics company GlobalData expects that the US will contribute the most to the growth of the CKD market due to the higher prevalence of CKD in this market, as well as the substantially higher cost of prescription medications in the US compared with Europe and Japan.

CKD is a condition characterised by a gradual loss of kidney function over time. This leads to the accumulation of excess fluid and waste in the body.

In the early stages, CKD is a largely asymptomatic condition. As the disease progresses, symptoms worsen and eventually lead to kidney failure.

The pressure for pharmaceutical companies to be more innovative with their therapies and tackle unmet needs is increasing.

Companies are approaching the CKD market with strategies for optimising treatment safety and compliance, as well as developing novel drug classes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe use of angiotensin-converting enzyme inhibitors and angiotensin II receptor blockers has remained relatively consistent, and the use of sodium-glucose transporter 2 inhibitors has become well-established for CKD.

Over the forecast period of 2023-2033, GlobalData expects the launches of promising pipeline drugs REACT, Ozempic, the zibotentan + dapagliflozin combination, and the balcinrenone + dapagliflozin combination to increase market size and further promote growth.

Overall, the level of unmet needs in the CKD market is high.

A major issue identified by some of the key opinion leaders (KOLs) interviewed by GlobalData is the dosing of CKD therapies.

A large proportion of CKD patients are taking suboptimal doses of relevant medications, leading to a worsening of symptoms and disease progression.

Factors that contribute to this issue are not simply patient compliance and cost, but also difficulty in balancing comorbidities, and adverse effects associated with the optimal dose of certain CKD therapies.

Interviewed KOLs recognise that better management of patients and increased patient and physician awareness would improve this issue.

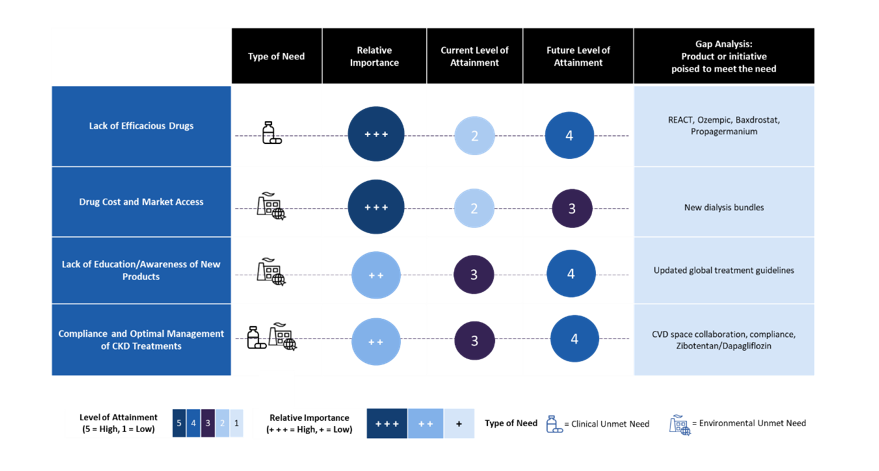

Figure 1 outlines the key unmet needs in the CKD space and rates their level of attainment in the CKD markets now and through the end of the forecast period (‘1’ equals low attainment and ‘5’ equals high attainment).

The unmet needs are also stratified by level of importance (high, moderate, or low).

GlobalData believes that it will be easier for new drug entrants to capture CKD market share if they offer a novel mechanism of action or help to improve compliance.

KOLs hold mixed views on adding another drug on top of their patients’ complex treatment regimens.

Overall, nephrologists surveyed by GlobalData have indicated that the pipeline for CKD is somewhat promising, but a significant improvement in efficacy would have to be demonstrated by any therapy for it to become either a replacement or add-on to existing therapies.