A report published by the US Food and Drug Administration (FDA) in 2019 titled ‘Drug shortages; Root Causes and Potential Solutions?’ identified the lack of

incentives for manufacturers to produce less profitable drugs as one of the root causes of drug shortages.

This report remains relevant five years later as the industry is still plagued by these challenges.

They were also a popular topic at the Clinical Trial Supply 2024 conference held in Barcelona, Spain, on 6-7 May, where Thomas Thoma, head of Managed Access

Programs – Clinical Trial Supply, Global Health Tendering and Global Shortages, explored why this issue is still pertinent and the impact these shortages have on patients.

During his presentation, Thoma revealed that 33% of all Phase III clinical trials use at least one product suffering from shortages.

Thoma then shared that 93% of US cancer centres reported oncologic shortages in May 2023 and that the issue became so pressing that in July 2023 the FDA allowed the temporary import of unregistered oncologic preparations from China to alleviate the shortages.

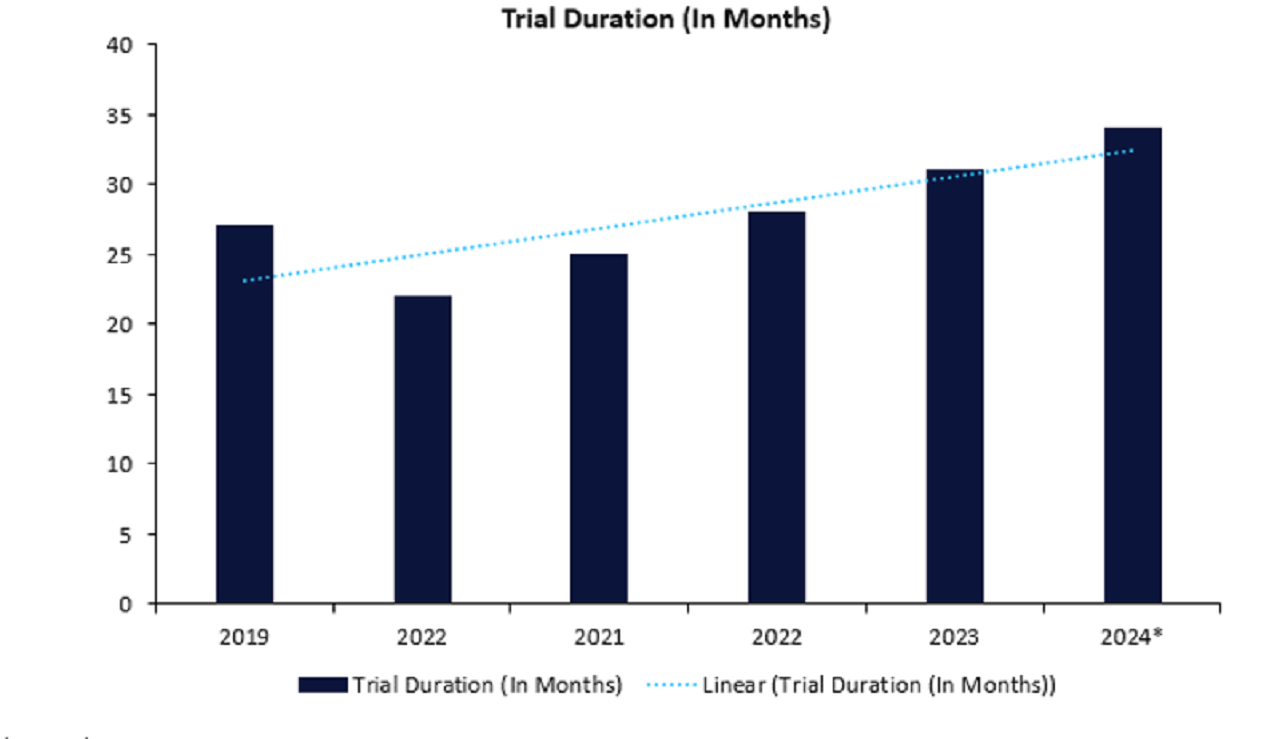

Data obtained from leading data and analytics company GlobalData’s Trials Intelligence platform corroborates the potential impact this has had on clinical trials, indicating that Phase III trial durations have steadily increased over the last

five years, as shown in Figure 1.

Additionally, a National Comprehensive Cancer Network Survey performed in May 2023 found that 70% of 27 cancer treatment centres surveyed were low on cisplatin, which is a widely used platinum-based chemotherapy drug that treats up to 20% of all patients with testicular, lung, bladder, cervical, and ovarian cancers.

Although it is a generic drug that has been available for decades, the numerous approved manufacturers have been unable to keep up with the demand.

Insights from GlobalData’s Trials Intelligence platform revealed that the number of delayed clinical trials using Cisplatin that ended in 2023 increased by 17% compared to those that ended in 2022.

Drug shortages among generics are not expected to disappear any time soon, as about 50% of generic drugs do not turn a profit, according to David Gaugh, interim president and chief executive officer of the Association for Accessible

Medicines.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis means that there are very few financial incentives to remedy generic shortages. This is extremely worrying, as 90% of prescriptions in the US are for generic drugs, as are 81% of all drugs in the UK, which the UK National Health Service relies on

to generate savings.

In turn, the prevailing drug shortages have left hospitals making difficult decisions, including rationing medications and prioritising patients with better outlooks.

Although the FDA recommended several solutions to combat the lack of incentives causing shortages in its 2019 report, the uptake of these solutions appears to be slow, and the data indicates that the healthcare industry is reaching a critical point with the potential to result in catastrophic consequences to public health.