Risk is inherent in clinical supply chains. “The secret to risk mitigation is people,” shared Francesco Santo, director of Clinical Supply Chain at Orano Med (Plano, TX), speaking at the Clinical Trial Supply (CTS) New England conference in Boston, Massachusetts. “Strong communication and relationship management creates visibility, and visibility gives you greater control over potential supply chain issues such as vendor delays, label changes, customs hold-ups, and under-forecasting or overcommitting clinical supply,” said Santos in a session named “Protecting your clinical supply chain: minimising disruption through effective risk mitigation planning.” Many speakers at the conference, which took place on 8-9 April 2025, noted the importance of establishing meaningful connections with suppliers, vendors, and other stakeholders, as they are extensions of a sponsor’s team in managing clinical trials and the supply chain.

Santo shared that common blind spots in clinical supply chains are underestimating label approval timelines, assuming regulatory timelines without confirming, not fully vetting import requirements, Interactive Response Technology (IRT) site training gaps, or overconfidence in vendor readiness. By building strong relationships with external stakeholders from the beginning of the trial or even before the trial begins, sponsors can leverage the relationships to mitigate these blind spots or other supply chain disruptions. While using these relationships to establish contingency protocols from the beginning of the trial may not prevent disruption, it can ensure that the disruptions do not stop the trial.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

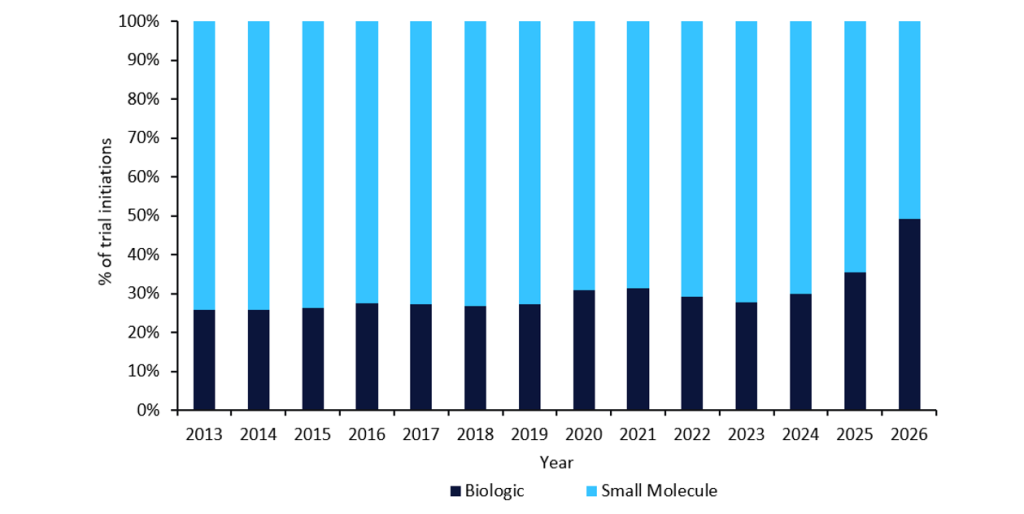

While implementing contingency protocols and other mitigation tactics can ensure a trial’s successful completion, there are also other factors, such as cost, that need to be considered in developing flexible clinical trial supply manufacturing strategies. Speakers in a panel discussion at CTS New England titled “Exploring strategies for flexible clinical trial supply manufacturing” stressed that the scale and capacity of a trial drive the cost. They highlighted the importance of understanding the scope of the trial, geographic location, the demand for and the type of the drug, and the timeframe for trial start-up, as these are all factors that will influence cost. For example, a biologic is more costly to develop than drugs of other molecule types, as it requires longer development timelines and specialised requirements for trials and manufacturing due to its complexity. According to GlobalData, biologic trials have also been increasing in proportion over the past 12 years, indicating an overall shift in focus of the industry to biologics over small molecules for innovator drugs (Figure 1).

Figure 1: Innovator trial initiations by molecule type, 2013–2026

This shift towards biologic trials also underscores the growing complexity of clinical trials and the resulting increase in clinical trial costs that has been witnessed over the past decade.

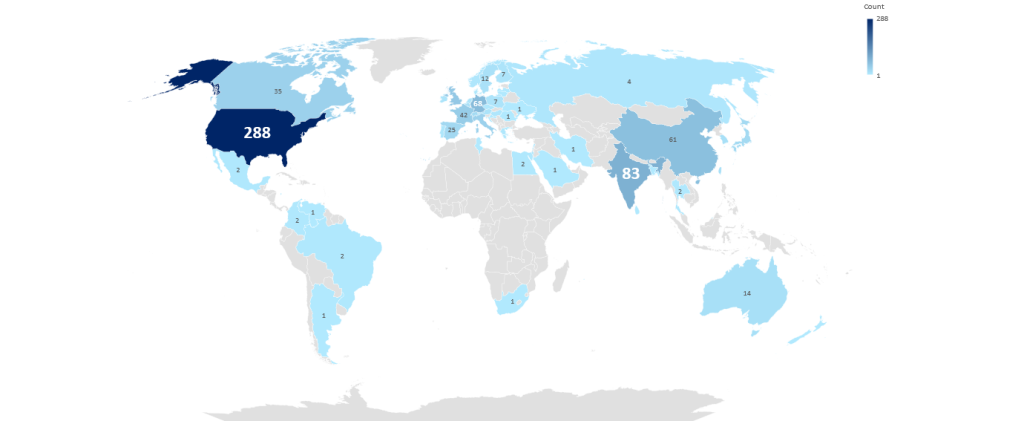

Other considerations shared at the conference include using target product profiles, epidemiology data, and market size information to help ground assumptions when comparing CDMO capabilities to the needs of the drug programme in choosing a clinical supply manufacturer. Speakers also suggested considering a CDMO’s readiness for global expansion, such as facility location or the ability to obtain raw materials and in the required quantities. According to GlobalData, the highest number of clinical dosage form contract manufacturing sites can be found in the US, followed by India and then Germany (Figure 2). Due to the impending US Senate decision on the passing of the BIOSECURE Act, the US may see an increase in contract manufacturing sites, which could also help offset the costs associated with Trump’s tariffs. However, the BIOSECURE Act could spur opportunities for emerging markets, with Indian CDMOs well-positioned to witness growth due to their cost-effectiveness and highly skilled workforce.

Figure 2: Worldwide clinical dosage form contract manufacturing facilities

Estimating demand

Although employing larger batch sizes to cover trial demand variability is often a typical solution in the supply chain, costs are a concern with this strategy. Considering the previously mentioned data types and factors as a part of a supply chain strategy can help sponsors more accurately predict batch size and manufacturing size to help ensure a CDMO’s capacity can support the needs of the clinical trial.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor example, speakers at CTS New England suggested taking a phase-appropriate approach to batch size, since the manufacturing needs for a Phase I trial differs from a Phase III trial. Material for a Phase III trial should closely resemble a sponsor’s commercial process once a drug has received marketing approval, which will also likely be a higher volume than Phase I. Some, but not all, manufacturing facilities can grow with a trial, moving from lower to higher capacity manufacturing. Smaller CDMOs can be more cost-effective, efficient, or in the best geographic location for a Phase I trial, which are important considerations for sponsors with drugs in earlier development stages. However, if the drug progresses to later trial phases, a sponsor may need to move to a larger or more commercially oriented manufacturer. Scoping and tracking a CDMO’s future capacity is important, so that clients can pivot to the larger CDMO more easily and efficiently when the drug moves to later stages.

When choosing a manufacturer from a commercial perspective, the inherent assumption is that demand for the drug will continue to increase, especially for a large disease indication. However, not all drugs reach later stages, or demand forecasts may not materialise. Thus, speakers at CTS New England reiterated that leveraging any available data—such as staying informed on future capacity using drug product profiles, epidemiology data, market size, and facility-specific geographies and information—can build in flexibility from the start of the trial, whether that be by choosing the appropriate CDMO strategy or creating transparency in the decision-making process as sponsors build and maintain these relationships with external stakeholders and vendors.