Diabetic neuropathic pain (DNP) is clinically defined as pain resulting from peripheral, autonomic, focal or proximal nerve damage in patients with diabetes. It most commonly manifests distally to affect the hands and feet and can occur in patients with either a type 1 (T1D) or type 2 diabetes (T2D) diagnosis. Symptoms vary from tingling, burning, sharp, shooting or lancinating pain. DNP in the majority of patients is considered moderate to severe, and is often worse at night, resulting in sleep disturbance.

Diagnosis and treatment management does not differ greatly between patients with T1D and T2D, even though it is more commonly experienced in those suffering from T2D. The pathophysiology of DNP remains poorly understood and there is a lack of a universal definition, as a diagnosis of the condition is subjective to the individual neurologist or diabetes specialist, as well as patient-reported pain experience.

The majority of patients who suffer from DNP are adequately treated and their pain is controlled. Generic analgesics and tricyclic antidepressants (TCAs) are used most frequently in disease management. In addition to these agents, anticonvulsants, serotonin-norepinephrine reuptake inhibitors, gabapentinoids and sodium channel blockers are often prescribed as first-line therapies. Topical treatments such as capsaicin and glyceryl trinitrate spray, as well as combination therapies, are utilised in the second line. However, despite numerous effective treatments being available, according to key opinion leaders previously interviewed by GlobalData, up to 30% of patients are refractory and do not respond to marketed treatments.

With academic societies and regulatory bodies generally discouraging the use of opioids, which would have previously been used as an alternative, due to their addictive nature and potential for abuse, there is a massive need for additional effective pain-relieving treatment options. Furthermore, both approved and off-label therapies can only provide symptomatic relief to patients. As such, the DNP market suffers from a lack of curative or disease-modifying products.

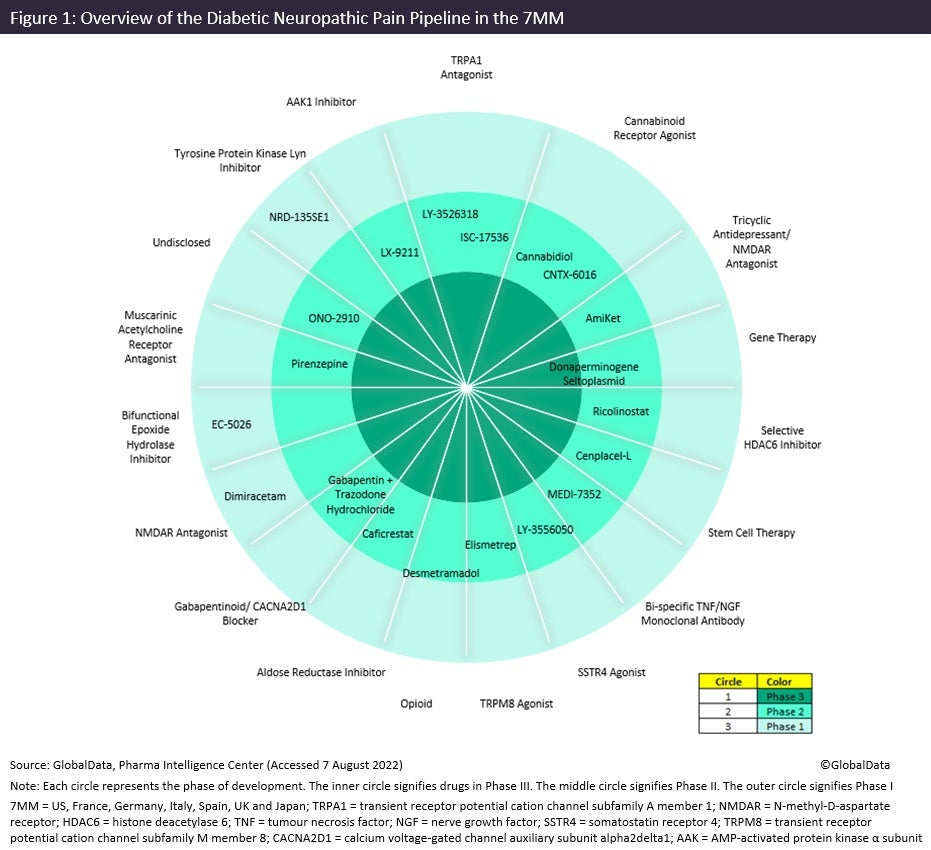

Figure 1 summarises products within the DNP pipeline in the seven major markets (7MM: US, France, Germany, Italy, Spain, UK and Japan) across all stages of clinical development and their molecular targets.

Symptomatic therapies still dominate the pipeline, including both those that are exploring novel mechanisms of action or combining products from the current market. Immune Pharmaceuticals’ AmiKet (amitriptyline + ketamine hydrochloride) and Angelini Spa’s gabapentin + trazodone hydrochloride are novel combination therapies. However, amitriptyline, gabapentin and trazodone are already marketed for DNP, which could limit the uptake of the combined formulations by patients, as inexpensive generics are available separately throughout the 7MM.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere are several pain-relieving drugs in the pipeline with new mechanisms of action that may offer an appealing alternative. Two such early pipeline therapies are Bristol Myers Squibb’s ricolinostat, which is a selective histone deacetylase inhibitor, and Eicosis’ EC-5026, a bifunctional epoxide hydrolase inhibitor, of which neither class has been used in the DNP market before. Another novel target for DNP is Lexicon Pharmaceuticals’ LX-9211, an AAK1 inhibitor, which was shown to be efficacious in its Phase II trial (NCT04455633) that ended in April this year. Furthermore, Eli Lilly’s LY-3526318 and LY-3556050 are being studied as part of Lilly’s pain master protocol. This is an initiative that aims to expedite the development of new treatments for chronic pain, highlighting the urgent need for novel DNP therapies.

Ultimately, therapies that target the specific molecular mechanisms involved in the pathogenesis of DNP that are disease-modifying or curative by nature are the goal of drug development for the disease. There is, however, only one disease-modifying agent in the late-stage pipeline: Helixmith’s donaperminogene seltoplasmid, also known as Engensis. Engensis is a plasmid DNA product designed to express recombinant HGF protein in nerve and Schwann cells to promote nervous system regeneration and prevent DNP. It would be the first disease-modifying agent to enter the market, and therefore a potential gamechanger due to its unique profile.

Engensis’ use is likely to be limited by cost, however, meaning it may only be used in DNP patients with chronic, severe disease. The drug’s cost would certainly impede drug reimbursement by payers and inexpensive generic use will be favoured. Furthermore, results from a recent Phase III study (NCT02427464) were disappointing in comparison to those published previously, as Engensis failed to meet its efficacy endpoint. Despite this, there are two additional ongoing Phase III trials (NCT04469270 and NCT04873232) to determine its efficacy, concluding in December 2022 and 2023, respectively, which may show more promising results.

GlobalData’s analysis of the DPN pipeline suggests that there are many promising agents in development with strong efficacy and safety profiles to provide symptomatic relief. However, more development of drugs with disease-modifying mechanisms to resolve the unmet clinical need is necessary. Opportunity, therefore, remains for developers to continue to conduct clinical research in this area, with the hopes of more disease-modifying agents entering the space in future to overcome the unmet clinical need.