At the European Society of Medical Oncology (ESMO) Congress 2024, updated efficacy and safety data from the randomised, controlled Phase III IMbrave050 clinical trial were presented on 13 September. This trial evaluated the combination of Roche’s Tecentriq (atezolizumab) and Avastin (bevacizumab) as an adjuvant therapy in patients with resected or ablated high-risk hepatocellular carcinoma (HCC).

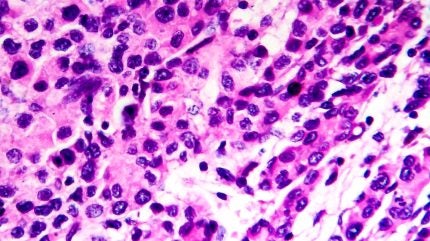

HCC is the most frequent type of primary malignancy of the liver and accounts for 75–90% of all primary liver cancers. According to GlobalData’s Hepatocellular Carcinoma: Epidemiology Forecast to 2029, the number of diagnosed incident cases of HCC in the eight major markets (8MM: US, France, Germany, Italy, Spain, UK, Japan, and China) will grow to 343,761 cases by 2029. Patients with early-stage HCC at high risk of tumour recurrence are treated with liver transplants, surgical resection, or locoregional therapies if surgery is not possible, and adjuvant therapy is not standard practice.

In the IMbrave050 trial, a total of 668 patients (mostly males from Asia Pacific countries) with high-risk HCC (based on tumour size and number, vascular invasion, and tumour differentiation) were 1:1 randomised to experimental arm A (Tecentriq + Avastin) and comparator arm B (active surveillance). The primary endpoint, independent review facility (IRF)-assessed median recurrence-free survival (RFS) of Tecentriq + Avastin was 33.2 months (hazard ratio (HR), 0.90; 95% CI: 0.72, 1.12), compared to 36.0 months for active surveillance. At the updated interim analysis (IA), the median follow-up duration was 35.1 months, and the secondary endpoint of overall survival was immature (HR, 1.26; 95% CI: 0.85,1.87). The safety profile was manageable, though 36.1% of patients experienced Grade 3 or 4 treatment-related adverse events (AE), and two Grade 5 AEs were observed in the experimental arm A. This updated interim analysis result does not support Tecentriq + Avastin use as an adjuvant for all patients (including subgroups) with high-risk HCC, and efficacy follow-up will be continued in the IMbrave050 trial.

Following the notable failure of Bayer’s Nexavar (sorafenib) as adjuvant therapy for patients with resected or ablated HCC in the Phase III STORM study, this trial result brings another disappointment in treating early-stage HCC patients. However, the trial does not answer whether the addition of Avastin is essential or Tecentriq alone is sufficient to demonstrate efficacy, as single-agent immunotherapy shows fewer side effects compared to a combination of immunotherapy and anti-vascular endothelial growth factor inhibitor. This negative trial result came as a surprise since there was a clear RFS benefit in the earlier interim analysis.

Meanwhile, the Phase III CheckMate 9DX study is evaluating Bristol Myers Squibb’s Opdivo (nivolumab) as a monotherapy in the same patient population, with an expected completion date in late 2025, and the Phase III KEYNOTE-93 trial is investigating the safety and efficacy of Merck & Co’s Keytruda (pembrolizumab) as monotherapy with an estimated completion date is Q3 2029. If Opdivo demonstrates strong efficacy as a single-agent immunotherapy with fewer side effects, it could secure early market access as an adjuvant therapy in HCC. In addition, if another Phase III EMERALD-2 study shows positive results by mid-2027, AstraZeneca’s Imfinzi (durvalumab), either as a monotherapy or in combination with Avastin, could pose competition to Opdivo. However, since IMbrave050 failed to show significant efficacy, it also raises concerns about the potential success of Imfinzi in combination with Avastin.

According to GlobalData’s analyst consensus forecast, global sales for Tecentriq and Avastin are projected to reach $4.85bn and $644m, respectively, while Opdivo and Keytruda are expected to reach global sales of around $9.25bn and $23.18bn, respectively, by 2030. However, all these immunotherapies will face fierce market competition because of biosimilars, as those immunotherapies will lose US market exclusivity by 2031.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData