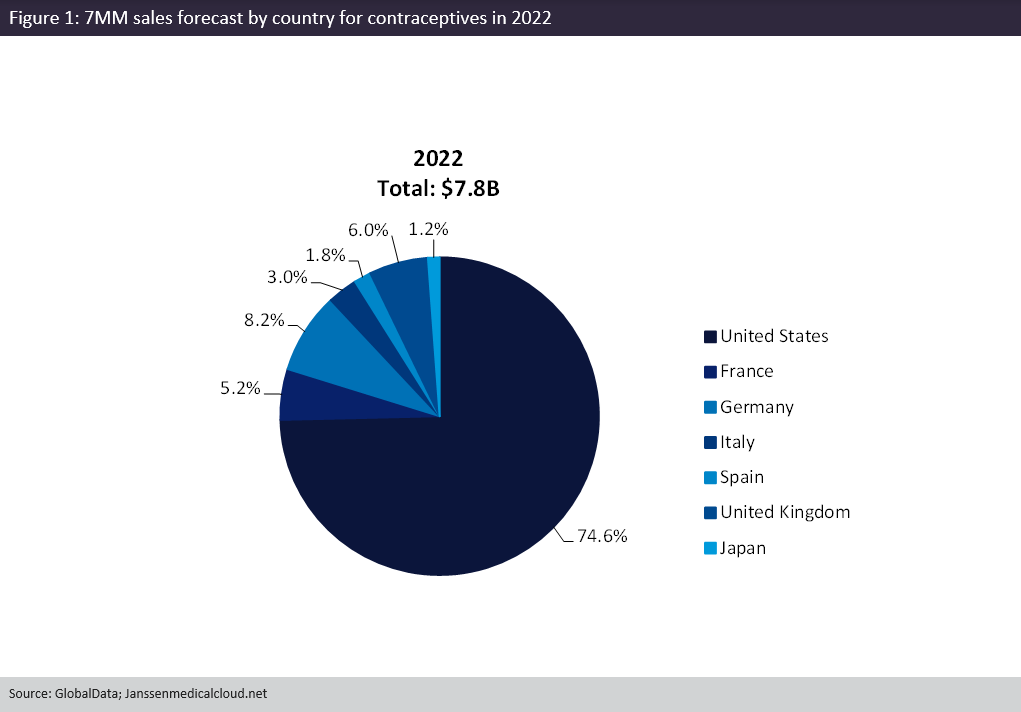

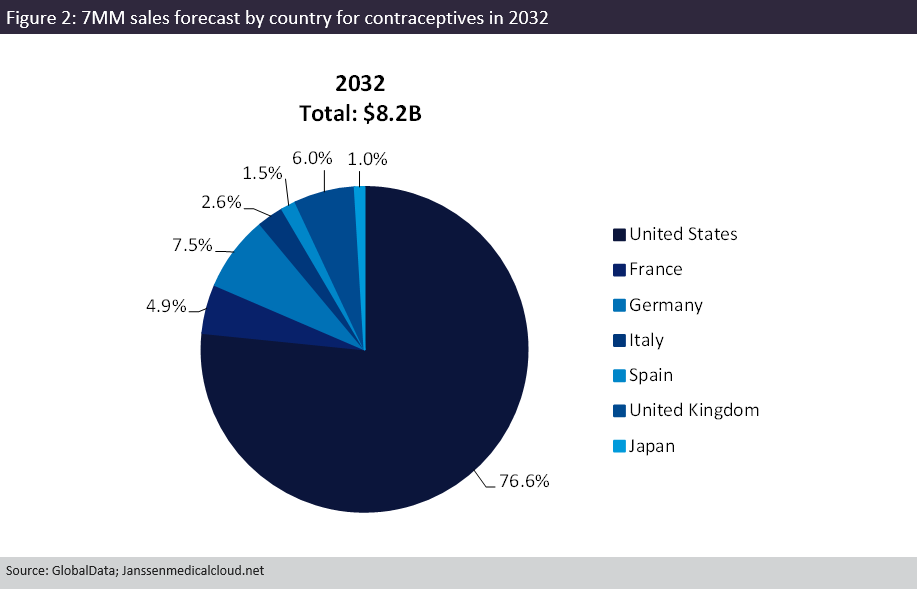

The female contraceptives market is expected to exhibit slight growth from $7.8 billion in 2022 to $8.2 billion in 2032, at a compound annual growth rate (CAGR) of 0.5% across the seven major markets (7MM: France, Germany, Italy, Japan, Spain, the UK and the US), according to GlobalData’s upcoming report, Female Contraceptives: Seven Market Drug Forecast and Market Analysis

The contraceptive market has been dominated by intrauterine devices and oral contraceptives for the decade up to 2023. At present, oral contraceptives dominate patient shares in the contraceptive market, and this trend is not projected to dramatically change up to 2032. The majority of sales will come from the US, which will maintain its 2022 lead and command 76.6% of the 7MM contraceptive market by 2032. Japan’s sales will fall at a negative CAGR of 1.5% by 2032 as a result of a decreasing female population, making up 1% of global sales. The UK’s sales will increase between 2022 and 2032 at a CAGR of 0.5% due to an increasing female population. The rest of the markets (France, Germany, Italy, and Spain) will have decreasing sales, mainly as a result of decreasing female populations (Figures 1 and 2).

The contraceptive pipeline is limited, but Exeltis Pharmaceuticals’s dienogest + ethinylestradiol PR will enter the contraceptive space in the US, Spain, and the UK. Two pipeline drugs already marketed in the US and 5EU, Fuji Pharma’s Estelle (drospirenone + estetrol) and ASKA Pharmaceutical’s drospirenone, will enter the contraceptive space in Japan.

The figures below summarise the global sales forecast by country for contraceptives in 2022 and 2032 across the 7MM.

Major drivers of growth in the contraceptives market over the forecast period include:

- The launch of one new pipeline drug in the US, Spain and the UK, and the launch of two marketed drugs in Japan during the forecast period

- The growing US and UK populations, resulting in increased sales throughout the forecast period

- The continued success of oral contraceptives

- The increased use of other methods of contraceptives, such as intrauterine devices, transdermal patches and vaginal gels, which will increase growth in some of the 7MM

Major barriers to the growth of the contraceptives market during the forecast period include:

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData- No pipeline drugs being launched in Germany and Italy during the forecast period

- A decrease in the 5EU and Japanese populations throughout the forecast period, which will result in decreased contraceptive sales in these markets

- Lack of launch of new contraceptives across the 7MM, hindering global sales growth

- Limited choice and the relatively low proportion of hormonal contraceptive use in Japan, which will hinder contraceptive sales growth

- Cultural and religious opposition and misconception in certain markets, such as Japan and Italy, which will limit sales growth

- Re-imbursement issues and lack of insurance coverage, which will slow down the uptake of the more costly contraceptives in the US.