The female infertility market is expected to grow moderately from $1.6bn in 2023 to $2.3bn in 2033, at a compound annual growth rate (CAGR) of 3.5% across the seven major markets (7MM: US, France, Germany, Italy, Spain, UK, and Japan), according to GlobalData’s Female Infertility: Seven Market Drug Forecast and Market Analysis report.

This growth during the forecast period will primarily be due to the growing number of women who are postponing pregnancy until later in life, when fertility has generally decreased due to age. As well as a small growth attributed to the launch of therapies during the forecast period. GlobalData expects the launch of the pipeline drugs Kissei Pharmaceutical’s linzagolix choline, IBSA Institut Biochimique’s subcutaneous progesterone and Ferring Pharmaceuticals’s Menopur (menotropin). However, a small number of established companies compete in the female infertility market and the market is dominated by off-label therapies, with many drugs used during fertility treatments being indicated for breast cancer and other gynaecological disorders, presenting a stiff barrier to the entry of novel therapies.

Drugs used to treat female infertility have remained largely unchanged, hence Merck Sereno’s Gonal-F remains the top-selling drug for female infertility with forecasted sales of $713m by 2033. The key opinion leaders (KOLs) interviewed by GlobalData described the level of unmet need in this market as moderate. It would be highly desirable to simplify the IVF process by improving the route of administration and dosing frequency of the various drugs involved in the process.

Of the 7MM included in this forecast, the US is the most significant contributor to the female infertility market, accounting for 58.5% of sales in 2023 and 66.0% of sales in 2033. This is primarily due to the higher price tag of therapeutics in the US compared to the other markets, as well as the higher prevalence of female infertility in the country. Spain is expected to contribute the least to the female infertility market, accounting for 4.5% of sales in 2023 and 4% of sales in 2033.

The major drivers of growth in the female infertility market during the forecast period include the following:

- A growing number of women are postponing pregnancy until later in life, when fertility has generally decreased due to age.

- The ART treatment rates in the 7MM are projected to increase during the forecast period.

- Kissei Pharmaceutical’s linzagolix choline will launch in the US, France, Spain, and Japan.

- IBSA Institut Biochimique’s subcutaneous progesterone will launch in the US.

- Ferring Pharmaceuticals’s Menopur (menotropin)will launch in Japan.

- The major barriers that will restrict the growth of the female infertility market during the forecast period include the following:

- The pipeline for new female infertility treatments is considered sparse, with a lack of innovative drugs.

- The female infertility market is dominated by off-label therapies, with many of the drugs that are used during fertility treatments being indicated for breast cancer and other gynaecological disorders, presenting a stiff barrier to the entry of novel therapies

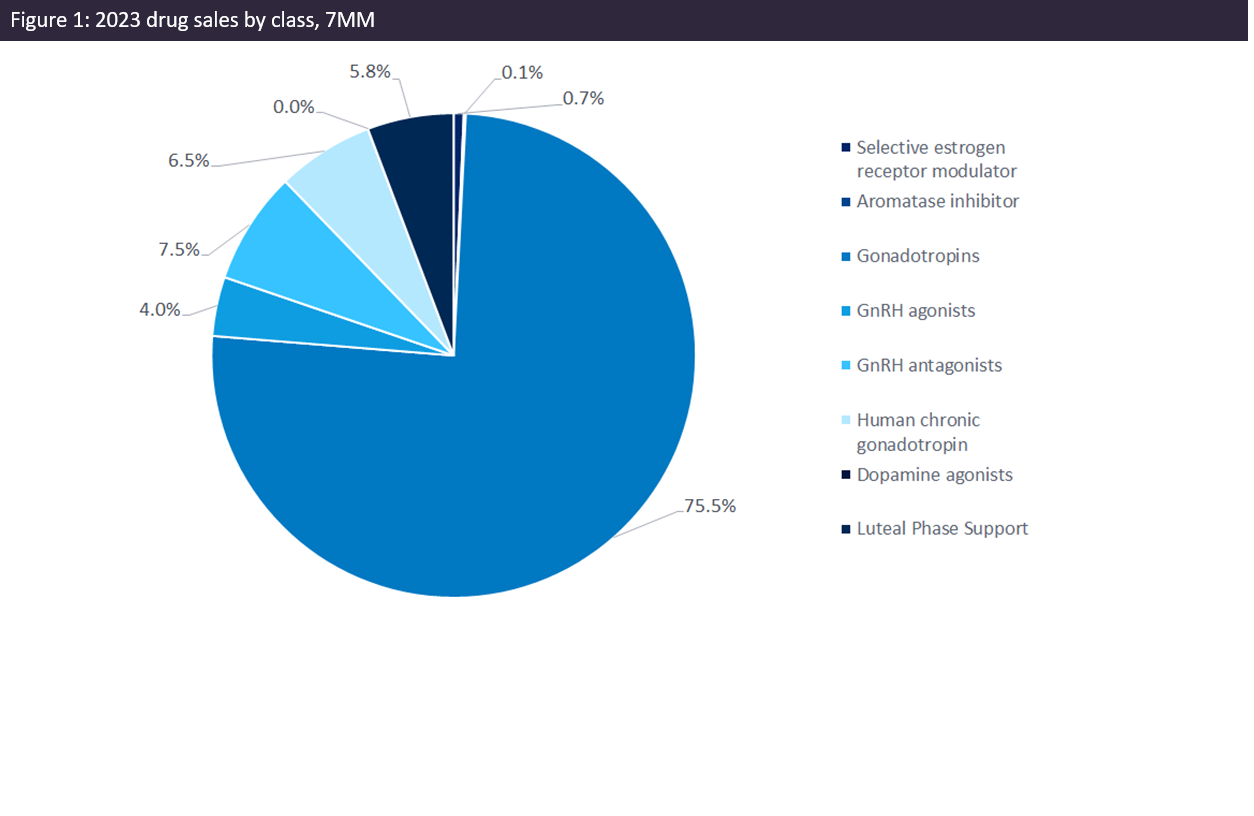

The figures above summarise the projected growth in the female infertility market across the 7MM from 2023 to 2033.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData