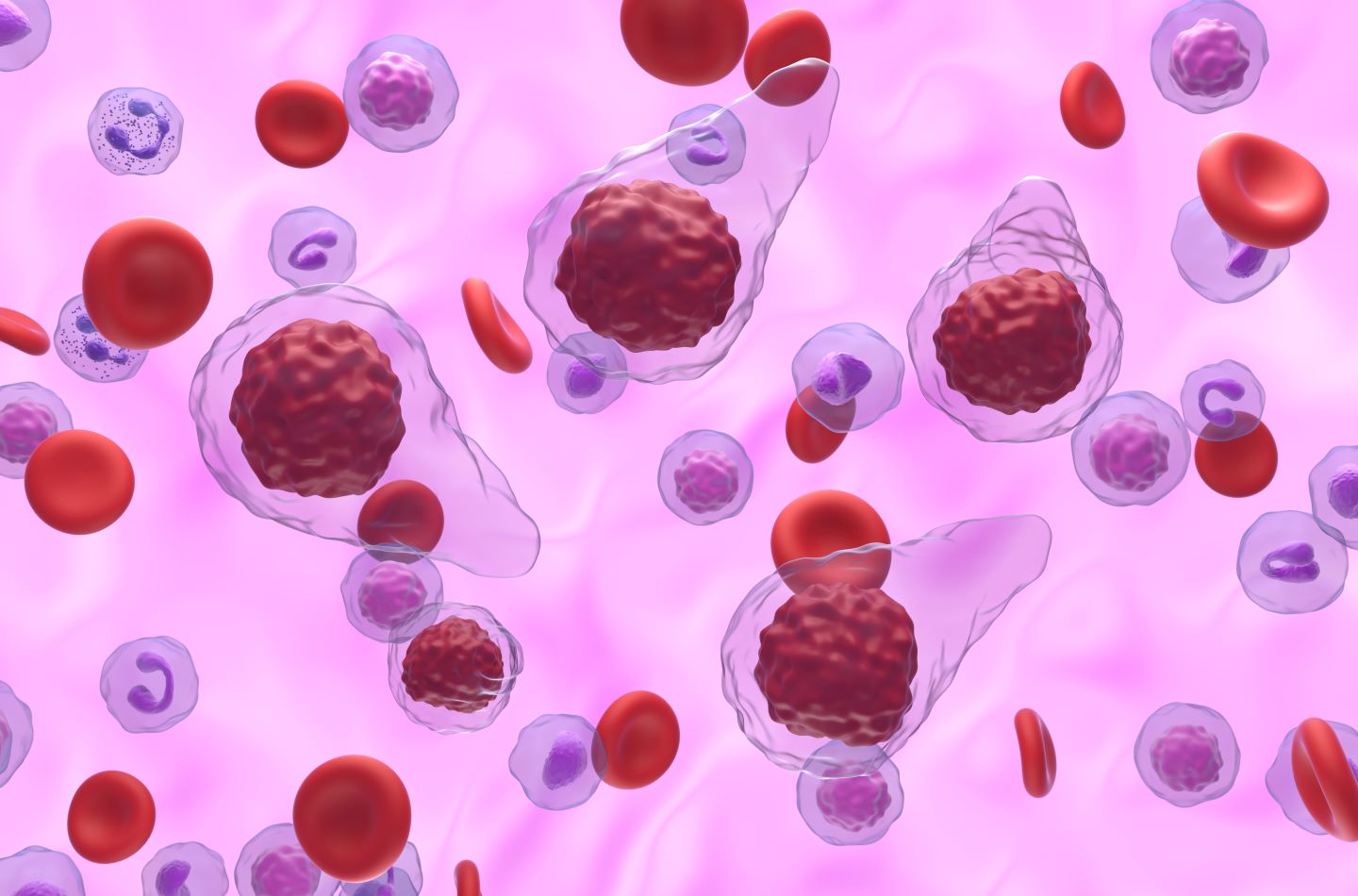

Multiple myeloma is the third most common blood malignancy globally. It accounts for 2% of all diagnoses and 1% of all cancer deaths globally. The area of multiple myeloma has seen significant clinical developments in the last two years, with the recent approval of bispecific T-cell engagers (BiTEs) such as Johnson & Johnson’s (J&J’s) Tecvayli (teclistamab) and Pfizer’s Elrexfio (elranatamab).

Chimeric antigen receptor T-cell (CAR-T) therapies have proven highly effective in relapsed/recurrent multiple myeloma (r/r MM). Bristol Myers Squibb’s Abecma (idecabtagene vicleucel) was the first CAR-T therapy approved in 2021 for the condition, and demonstrated good minimal residual disease-negative status (26% of 128 patients). This success was closely followed by J&J’s Carvykti (ciltacabtagene autoleucel), which was appraised in the CARTITUDE-1 clinical trial. The study enrolled 97 heavily pretreated (three or more lines of prior therapy) patients who were double refractory to proteasome inhibitors and immunomodulatory drugs (n=97). The overall response rate was 97%, the 12-month progression-free survival (PFS) was 77%, and overall survival (OS) was 89%. Based on these results, Carvykti received FDA approval in February 2022. The follow-up has shown a 27-month PFS and OS of 54.9% and 70.4%, respectively. This clinical evidence demonstrates strong long-term efficacy, which has led to enthusiasm about implementing the drug in earlier lines of therapy. With BiTEs and the rapidly developing area of CAR-T therapies, the later lines of multiple myeloma treatment will see patient share heavily contested. BiTEs are preferred over CAR T-cells due to having a relatively easier manufacturing process, increasing their availability and uptake in the market. CAR-T therapies, particularly Carvykti, have strong sustained response rates, with the CARTITUDE-1 study follow-up demonstrating a median response of 34.9 months among patients, potentially coming out ahead of the BiTEs class.

Fortunately for J&J, Carvykti’s label expanded to include r/r MM patients who had received one prior therapy based on the results of the CARTITUDE-4 study, the largest clinical trial to date involving Carvykti (n=419). MM patients who had received 1–3 prior therapies were randomised to either Carvykti or the physician’s choice of standard-of-care (SOC) therapy. After 12 months, the Carvykti arm demonstrated far superior PFS compared to the SOC arm (75.9% versus 48.6%) and a significantly higher number of patients having complete response or better performance (73.1% versus 21.8%). A press release from J&J at the beginning of July confirmed that the significance of these improvements will also translate to OS as early as the second line. The safety data for this study shows another side, however, as 76.1% of patients receiving Carvykti developed grade 1 or 2 cytokine release syndrome (CRS), with a further 1.1% developing grade 3 or 4 CRS. CRS is associated with renal failure, pulmonary oedema, and a host of other troublesome clinical presentations. The transition to earlier treatment lines with patients who have better performance status, compared to later lines, could make these side effects more tolerable and manageable. If J&J improves the management of these serious symptoms with patient support programmes and tools, Carvykti will become the preeminent force for second-line and later treatment for multiple myeloma, especially as the response rates among patient cohorts tested with Carvykti have been highly sustained and prominent.

GlobalData’s patient-based MM forecast projects Carvykti to reach blockbuster status this year with $1.3bn in sales across the eight major markets (8MM; US, France, Germany, Italy, Spain, UK, Japan, and China). Carvykti’s clinical efficacy compared to the SOC and Phase III trial data will translate into a significant market advantage over Abecma, at $6.2bn and $1.6bn in sales, respectively, across the 8MM by 2032. Gilead’s subsidiary, Kite Pharma, has partnered with Arcellx to investigate anitocabtagene autoleucel in MM treatment. Given Carvykti’s current positioning and highly saturated late-line treatment market, it is doubtful a newcomer makes any significant headway in the indication without overwhelming clinical results.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData