On 3 April, OncoSec published a press release stating that the Phase IIb KEYNOTE-695 trial of tavokinogene telseplasmid (Tavo) in combination with Merck & Co’s pembrolizumab (Keytruda) did not meet its primary endpoint of overall response rate (ORR). Previously, there was hope that this treatment method could induce remission in patients with advanced melanoma who had progressed after treatment with an anti-PD-1 checkpoint inhibitor, as single-arm trial data from November 2022 previously revealed that OncoSec was on track to claim the study as a success.

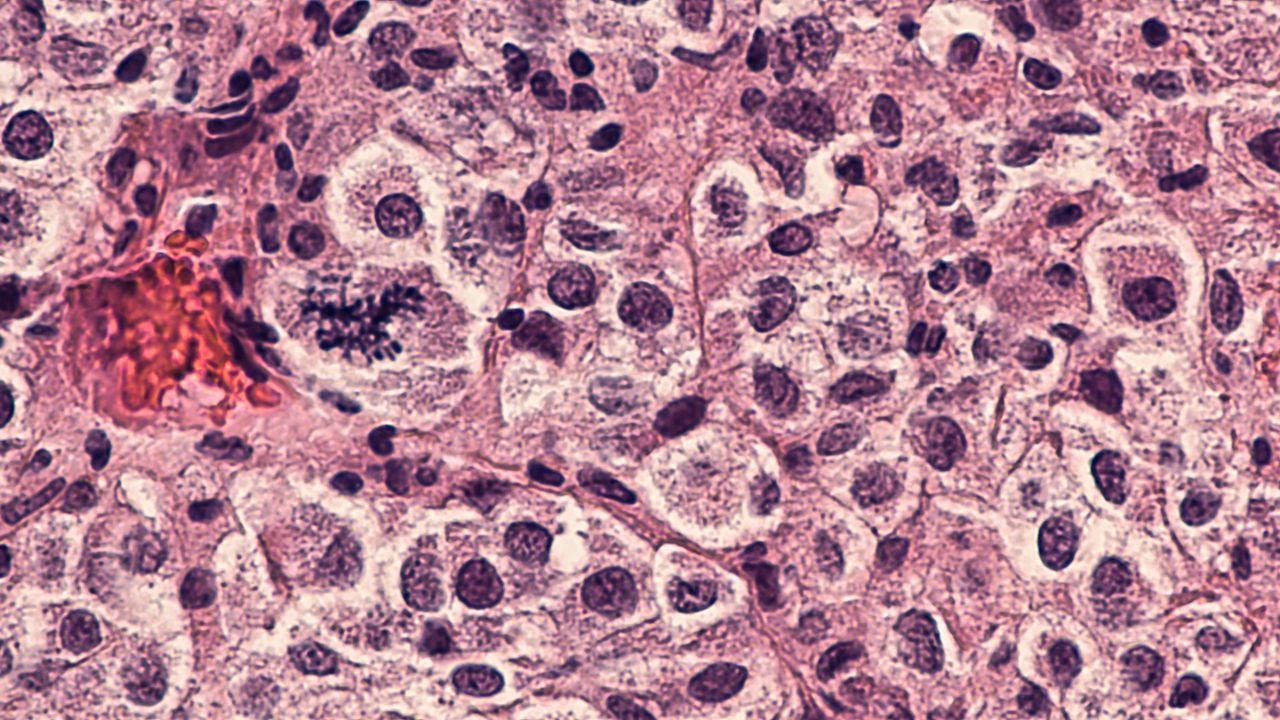

Immune checkpoint inhibitors (ICIs) such as anti-PD-1 or anti-CTLA4 agents are the standard of care for metastatic melanoma. While many patients show a long-term response, approximately 50% of them experience progression on ICIs, which leaves them with limited treatment options. Patients with anti-PD-1-resistant melanoma have a poor prognosis and their treatment needs are yet to be met.

Formerly, Tavo in combination with Keytruda was set to address this unmet need in this difficult-to-treat patient population. Tavo entails the injection of a plasmid that encodes for interleukin (IL)-12 directly into a tumour that can be easily accessed, followed by electroporation. As a result, the tumour cells express IL-12 at elevated levels, leading to a localised inflammatory response within the tumour microenvironment.

The idea behind OncoSec’s combination is that Tavo helps to stimulate the immune system to attack the cancer cells while Keytruda helps to enhance the immune response by blocking PD-1. Out of 98 patients who were evaluated for efficacy in the KEYNOTE-695 trial, the confirmed ORR was 10.2%. However, this percentage did not meet the pre-defined criterion for a clinically significant ORR of at least 17%, and was lower than the previously reported 18.8% ORR from November.

Previously, Tavo demonstrated a promising overall survival of 22.4 months in the post-ICI setting despite having a very low ORR. Alongside encouraging data from an investigator-sponsored trial in the neoadjuvant setting, Oncosec wants to pursue the development of Tavo further instead of abandoning the programme. Formerly, GlobalData forecasted global annual sales of Tavo at $800m in 2029 for the post-ICI setting, which is now lost as an opportunity for OncoSec.

While the market for melanoma therapies is highly competitive, with many established players, Tavo’s unique delivery mechanism involving electroporation gives it a distinct advantage in the market as it increases the uptake of anti-cancer agents and reduces systemic toxicity. In line with its goal, OncoSec is scheduled to meet with the US’ Federal Drug Administration next month to discuss plans for a randomised Phase II clinical trial in the neoadjuvant setting in the latter half of the year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData