The spinal muscular atrophy (SMA) market across the seven major markets (7MM: France, Germany, Italy, Japan, Spain, the UK and the US) is poised to grow at a compound annual growth rate (CAGR) of 1.2% from $2.7bn in 2023 to $3bn in 2033, according to GlobalData’s recently published report, Spinal Muscular Atrophy: Opportunity Assessment and Forecast. This modest growth will be driven by an increase in the population of patients eligible for gene transfer therapy and the anticipated introduction of three late-stage pipeline products during the forecast period.

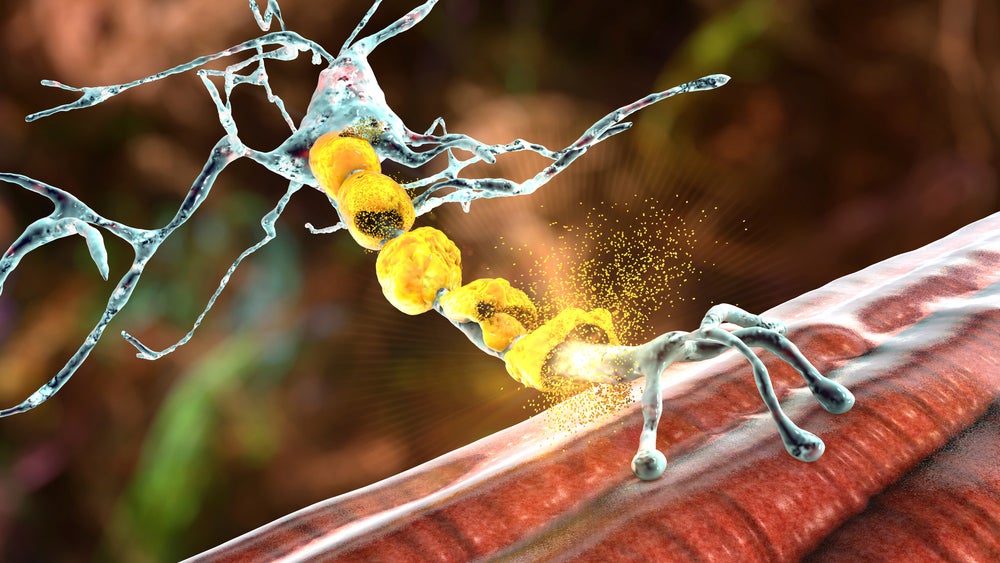

SMA patients have reduced levels of survival motor neuron (SMN) proteins due to SMN1 gene mutations or deletions. The current pharmacological management of SMA therefore relies on three SMN-dependent products. The availability of these disease-modifying therapies, Biogen’s Spinraza (nusinersen), Roche’s Evrysdi (risdiplam) and gene transfer therapy Novartis’s Zolgensma (onasemnogene abeparvovec), have greatly improved disease prognosis, allowing patients to reach normal childhood development milestones.

A key driver of growth for the SMA market is the anticipated launches of three myostatin inhibitors during the forecast period, which will together contribute $259.4m in sales by 2033. Rather than compete with existing therapies, Scholar Rock’s apitegromab, Roche’s RG-6237/GYM329, and Biohaven’s talditercept alfa aim to improve muscle strength and function in patients with SMA. They are being investigated as adjunct therapies that are intended to be prescribed in combination with marketed SMN-dependent products to optimise therapeutic benefit.

As such, polypharmacy in SMA patients is expected to increase over the forecast period. Currently, the use of polypharmacy is limited. Key opinion leaders (KOLs) interviewed by GlobalData noted that Spinraza or Evrysdi are prescribed as add-on treatments to Zolgensma in patients who still experience muscle weakness following gene transfer therapy.

Newborn screening will facilitate SMA detection

Another market driver is the potential label expansion of the intravenous formulation of Zolgensma to SMA patients weighing more than 8.5kg and up to 21kg, and the anticipated approval of an intrathecal formulation of Zolgensma for SMA type II patients aged two to 18 years. Reaching these regulatory milestones will increase the eligible population for gene transfer therapy.

The implementation of newborn screening for SMA throughout the 7MM will also facilitate detection of pre-symptomatic SMA cases and enable timely treatment intervention with Zolgensma. Sales of Zolgensma are projected to increase from $660.6m in 2023 to $763.8m by 2033.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe US represents the largest market for SMA, with 56.5% of the 7MM sales in 2023, increasing to 59.6% in 2033. The dominance of the US within the 7MM is due to its larger SMA population and higher drug prices.

While the SMA market is projected to grow during the forecast period across the 7MM, it may face some challenges that will slow its growth. Spinraza is set to lose market exclusivity in 2030 in the US and Japan, and in the remaining 5MM in 2031. This will allow cheaper biosimilar versions of nusinersen to enter the market and result in sales erosion of Spinraza. Nonetheless, the launches of the pipeline therapies, coupled with an increased uptake of Zolgensma, will fuel overall market growth in the SMA space.