During 2017, glucagon-like peptide-1 receptor agonists (GLP-1 RAs) and sodium-glucose cotransporter -2 inhibitors (SGLT-2 Is), approved across the seven major markets (7MM) the USA, 5EU (France, Italy, Germany, Spain, UK), and Japan, brought in >$8 billion in combined sales. Both T2D drug classes continue to gain substantial market share through the glycemic and non-glycemic benefits (e.g. CV benefits, weight and/or blood pressure reductions) they confer.

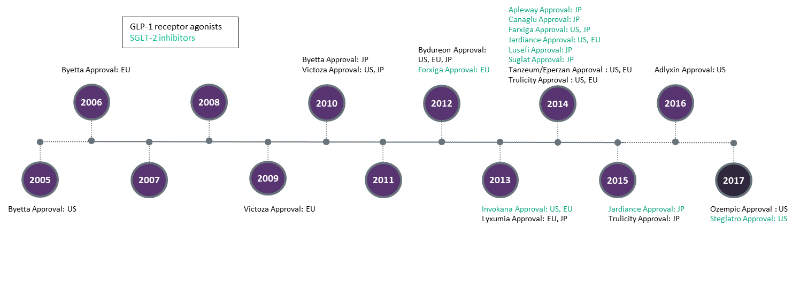

Across the 7MM, there are currently fourteen approved GLP-1 RAs and SGLT-2 Is collectively (not including combination varieties). The timeline of approved GLP-1 RAs and SGLT-2 Is in the 7MM can be seen in Figure below, with Novo Nordisk’s Ozempic (semaglutide) and Merck and Pfizer’s Steglatro (ertugliflozin) receiving the most recent regulatory approvals in 2017.

Ozempic is a once-weekly injectable GLP-1 RA drug that has been shown to provide significant reductions of both glycated haemoglobin (A1c) and the risk of major adverse cardiovascular (CV) events, as witnessed in the Trial to Evaluate Cardiovascular and Other Long-term Outcomes With Semaglutide in Subjects With Type 2 Diabetes (SUSTAIN-6).

Steglatro, a SGLT-2 I, provides significant A1c reductions while also harbouring numerous non-glycemic advantages, such as weight loss and a reduction in systolic blood pressure. Ozempic and Steglatro are set to launch in the US in 2018, and are expected to gain a significant share of the huge T2D market.

Despite the array of drugs currently available for T2D, additional treatments are required for patients to manage the chronic disease. Key Opinion Leaders interviewed by GlobalData agreed that a continued influx of GLP-1 RAs and SGLT-2 Is represent promising additions to existing T2D treatments, as they offer both glycemic and non-glycemic benefits.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPost 2017 GLP-1 RA and SGLT-2 I contenders include Novo Nordisk’s NN9924, an oral version of semaglutide, Sanofi’s sotagliflozin, a dual SGLT-1 and SGLT-2 I, and Theracos’ bexagliflozin, a novel SGLT-2 I. As such, GlobalData believes the GLP-1 RAs and SGLT-2 Is will experience the fastest growth of any T2D drug class.