Mei Pharma’s Phase II zandelisib has experts questioning its clinical worth in relapsed or refractory (r/r) follicular lymphoma (FL), owing to four other therapies already approved in the same setting with a similar mechanism. If zandelisib secures accelerated approval, it would be the fifth approved therapy that inhibits phosphoinositide 3-kinase delta (PI3K-delta) and any differentiation would be hard to tease, they said.

The main challenge with PI3K-delta inhibitors is their severe side-effect burden, and available data does not indicate zandelisib could differentiate itself in this regard, experts said. Intermittent dosing and its oral administration may help it argue some degree of differentiation, yet such a dosing approach can be adapted by other inhibitors in the class, and there is only one PI3K-delta inhibitor that is intravenously administered, they noted.

Mei Pharma was at this month’s American Society of Clinical Oncology (ASCO) virtual meeting to present updated data from the Phase Ib basket trial (NCT02914938) studying zandelisib, with the trial recruiting r/r FL patients. Topline data from the Phase II TIDAL study (NCT03768505), enrolling FL patients who have progressed from at least two prior therapies, is expected by the end of the year. The company has said TIDAL data will be used to file for an FDA accelerated approval. While zandelisib has an encouraging early efficacy signal, this only validates the ongoing TIDAL trial, experts noted.

The company also detailed at ASCO its Phase III COASTAL trial (NCT04745832) design, recruiting patients with indolent non-Hodgkin’s lymphoma such as FL. COASTAL is intended as a confirmatory trial to zandelisib’s potential accelerated approval in FL in third-line (3L) and beyond, as well as to investigate zandelisib in combination with Roche’s Rituxan (rituximab) in second-line (2L) FL. There is existing efficacy combination data supporting Rituxan plus a PI3K-delta inhibitor. But shifting zandelisib to an earlier setting may only exaggerate its severe side-effect profile, as observed with other inhibitors in the class, experts noted. COASTAL enrollment is expected to start mid-2021, as per a 19 May media release.

Zandelisib has $581m peak sales estimated for 2026, according to GlobalData consensus forecast. Mei Pharma, which has a $350m market cap, did not respond to a comment request.

Crowded PI3K-delta market makes differentiation challenging

With four therapies targeting PI3K-delta already approved, it will be challenging for zandelisib to differentiate itself, experts said. Gilead Sciences’ Zydelig (idelalisib) was approved in 2014, followed by Bayer’s Aliqopa (copanlisib) in 2017, Las Vegas, Nevada-headquartered Secura Bio’s Copiktra (duvelisib) in 2018, and TG Therapeutics’ Ukoniq (umbralisib) in February 2021. A head-to-head trial involving all PI3K-delta inhibitors may not be worth pursuing as safety/efficacy deviations are likely to be minor, added Dr Jonathan Friedberg, director, Wilmot Cancer Institute, University of Rochester, New York.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

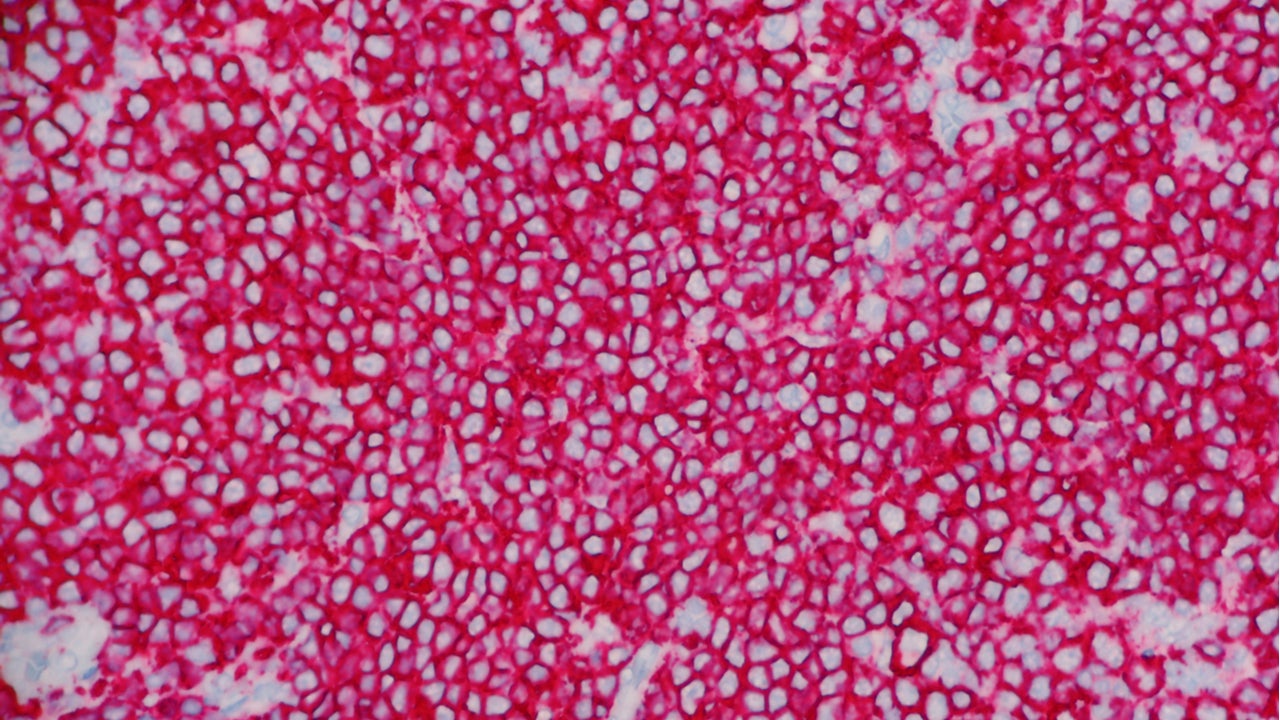

By GlobalDataThe main challenge for PI3K-delta inhibitors is their poor toxicity profiles, particularly in FL where patients have long survival, experts noted. About 80% of patients have long survival, as much as ten years, added Jude Fitzgibbon, PhD, professor, Personalised Cancer Medicine, Queen Mary University of London, UK.

Off-target side effects are their main concern, a hematology oncologist said. Zydelig and Copiktra both have black box warnings noting fatal and serious toxicities covering severe diarrhea, colitis and pneumonitis. Zydelig’s black box has specific warnings for intestinal perforation, while Copiktra’s specifically notes infections and cutaneous reaction risk. These side effects are significant enough that when clinicians do experience these issues with their patients, it could turn them off from considering the class again in the future, noted Dr Loretta Nastoupil, associate professor, Department of Lymphoma/Myeloma, University of Texas, MD Anderson Cancer Center, Houston.

The Phase Ib basket trial data presented at ASCO studied zandelisib intermittent dosing in 37 FL patients. Grade 3 events included neutropenia (six patients), ALT/AST increase (three patients) and rash (three patients), among others (abstract no 7550). Intermittent dosing, as also adapted in TIDAL, is a way to ease class-related side-effect issues, the oncologist said. In TIDAL, in the third treatment cycle, patients have one week on therapy and three weeks off. TIDAL previously had a continuous dosing arm, which was removed in February 2020.

But this intermittent dosing approach is not a zandelisib differentiating factor as this could be adapted by already approved therapies, experts said. While Ukoniq does not have a black box warning, its FDA label has a scheme advising clinicians of how to hold and/or reduce dosing once adverse events do appear. With Ukoniq approved only four months ago, more real-world experience is needed to spell out if it does have a safety advantage, Friedberg noted. More recently approved therapies reap clinician experience in managing toxicities related to the class, Nastoupil added.

Aliqopa, which also targets PI3K-alpha, has unique toxicities over the other PI3K-delta inhibitors, Friedberg said. Aliqopa does not have a black box warning but there are precautions that also cover the aforementioned side effects, as well as hyperglycemia and hypertension. But Aliqopa is administered intravenously (IV), which is cumbersome for use, particularly in FL with patients’ long survival, Friedberg and the oncologist noted. The three approved PI3K-delta inhibitors, and zandelisib, are orally administered. While orally administered therapies have been attractive due to the Covid-19 pandemic limiting hospital visits, some patients may still prefer the IV due to many factors such as their insurance coverage, Nastoupil added.

Efficacy data only a signal but class effect still expected

As for zandelisib’s efficacy data, while promising, it is currently from a small number of patients and so more data is needed, the oncologist noted. Even so, it would be challenging for any of these PI3K-delta inhibitors such as zandelisib to have a differentiated efficacy profile as a class effect is expected, Nastoupil said.

TIDAL has an overall response rate (ORR) primary endpoint. In the Phase Ib trial, which uses ORR as a secondary efficacy endpoint, 32 out of 37 3L and beyond FL patients had an overall response to the treatment, with 10 of these patients having complete response (CR). Of the 22 patients classified as POD24, 18 out of 22 patients reached the ORR endpoint, four of which had CR. POD24 patients represent 20% of FL patients, whose life expectancy is relatively shorter than others, Nastoupil noted. They are identified as ones who progress within 24 months of their diagnosis or from their first treatment, she said, adding these patients are ones with significant unmet need and so this data is a welcome early signal.

TIDAL is also recruiting marginal zone lymphoma (MZL) patients. MZL and FL patients belong in the same group of indolent lymphomas that progress slowly, the oncologist said. Due to them being in the same group with comparable therapeutic approaches, and that FL patients are more common, it is not uncommon that both patient groups are recruited in the same trials, she explained.

COASTAL is intended to be a confirmatory trial for zandelisib in FL in 3L and beyond, though patients also receive Rituxan as a combination partner. In 19 patients in the Phase Ib trial who also received Rituxan, 18 patients met the ORR endpoint. Combining Rituxan with a PI3K-delta is not a new approach, considering there is available data showing Aliqopa plus Rituxan lead to improved efficacy, Friedberg noted.

Still, the class’ side-effect profile remains an obstacle, which overall limits this class as a candidate for a combination partner, experts added. In the Phase III CHRONOS-3 trial (NCT02367040), serious treatment-emergent issues were reported in 145 (47%) of 307 patients in the Aliqopa/Rituxan arm versus 27 (18%) of 146 patients who received Rituxan plus placebo (Matasar, M, et. al, Lancet Oncol. 2021 May;22(5):678-689).

COASTAL is investigating zandelisib plus Rituxan in the 2L setting. The issue with moving PI3K-delta inhibitors earlier is that their side-effect issues become more severe, experts said. This could be due to these patients having more intact immune systems in the earlier setting, which make them more susceptible to adverse events, Friedberg explained. To be able to move to an earlier setting, any of these PI3K-delta inhibitors should demonstrate safety superiority over the other inhibitors in at least 3L, but this will be very challenging due to the expected class effect, the oncologist added.

Reynald Castaneda is an Associate Editor for Clinical Trials Arena parent company GlobalData’s investigative journalism team. A version of this article originally appeared on the Insights module of GlobalData’s Pharmaceutical Intelligence Center. To access more articles like this, visit GlobalData.