Oncopeptides’ Pepaxto (melflufen flufenamide) has investigators split about whether it is able to demonstrate superior efficacy over Bristol-Myers Squibb’s (BMS’) Pomalyst (pomalidomide) in a Phase III trial recruiting third-line (3L) and fourth-line (4L) relapsed or refractory multiple myeloma (MM) patients. However, Pepaxto may show superiority in patients with extra medullary disease (EMD) and have a safety profile advantage, they noted.

The 495-patient, Phase III OCEAN trial is powered to assess Pepaxto’s superiority and noninferiority potential versus active comparator Pomalyst. While investigators said noninferior efficacy data is FDA approvable, analysts argued Pepaxto should reach the superiority bar to have a clearer uptake path versus standard of care Pomalyst. If Pepaxto demonstrates superiority, an analyst report shows it could reach sales of up to $1.20bn. Oncopeptides has a market cap of $1.08bn (KR 9.42bn).

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

However, investigators were divided about whether Pepaxto could reach OCEAN’s superiority bar. Two investigators noted OCEAN’s highly refractory patient population as a barrier, but two other investigators highlighted the way Pepaxto’s alkylating mechanism offers a new approach in 3L and 4L patients as a reason to be optimistic. The investigators and a fifth expert agreed Pepaxto could best Pomalyst in EMD patients based on available Phase II data in patients with a median of five prior lines of therapy. Also, Pepaxto may be more appealing than Pomalyst due to Pepaxto’s side effect profile, which does not have a major impact on patient’s quality of life, they added.

Pepaxto is much better equipped to reach OCEAN’s noninferiority benchmark, the five experts said. Investigators in the open-label OCEAN backed Pepaxto’s noninferiority potential based on their in-trial experience. OCEAN is likely to deliver better results than the available Phase II data in later-line patients, which would translate to noninferiority in 3L and 4L patients, the five experts said. However, only showing noninferiority may be an uptake disadvantage, as Pepaxto is administered intravenously (IV) versus oral Pomalyst, they added.

Pepaxto and Pomalyst are both used in combination with glucocorticoid dexamethasone in OCEAN, with recruited patients required to have had two to four prior lines of therapy and be refractory to BMS’ Revlimid (lenalidomide). OCEAN topline results are expected in 2Q, an Oncopeptides spokesperson said. Pepaxto received FDA accelerated approval on 26 February in patients who have received at least four prior lines of therapy.

Superiority potential not direct

Hesitancy about OCEAN’s potential to demonstrate Pepaxto’s superiority is caused by 3L and 4L patients being heavily pre-treated and thus being challenging to treat, said OCEAN investigator Dr Ulf-Henrik Mellqvist, professor, Department of Haematology and Coagulation, Sahlgrenska University Hospital, Gothenburg, Sweden. Even if there was an increase in progression-free survival (PFS), which is OCEAN’s primary endpoint, it would likely not be high enough to demonstrate Pepaxto’s superiority, agreed OCEAN investigator Dr Moshe Gatt, director, Department of Hepatology, Hadassah Hebrew University Medical Centre, Jerusalem, Israel.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPomalyst was granted FDA approval on February 2013 in 3L and beyond patients in MM, based on Phase III NIMBUS trial data. In NIMBUS, Pomalyst plus dexamethasone reached a median PFS of four months versus 1.9 months with dexamethasone alone (p<0.0001; San Miguel, J, et al., Lancet Oncol. 2013 Oct;14(11):1055–1066).

In OCEAN, a PFS of close to 12 months would clear the superiority benchmark over Pomalyst, said OCEAN investigator Dr Roman Hajek, professor, faculty of medicine, university of Ostrava, Czech Republic. However, based on the experience of his own OCEAN patients, a 10-month PFS is more realistic to reach and would still be superior, he added.

Pepaxto could deliver superiority in OCEAN due to its mechanism as a peptide-conjugated alkylator, Hajek added. Pepaxto’s mechanism would be a different therapeutic approach in 3L and 4L patients, agreed OCEAN investigator Dr Fredrick Schjesvold, head, Oslo Myeloma Centre, Norway.

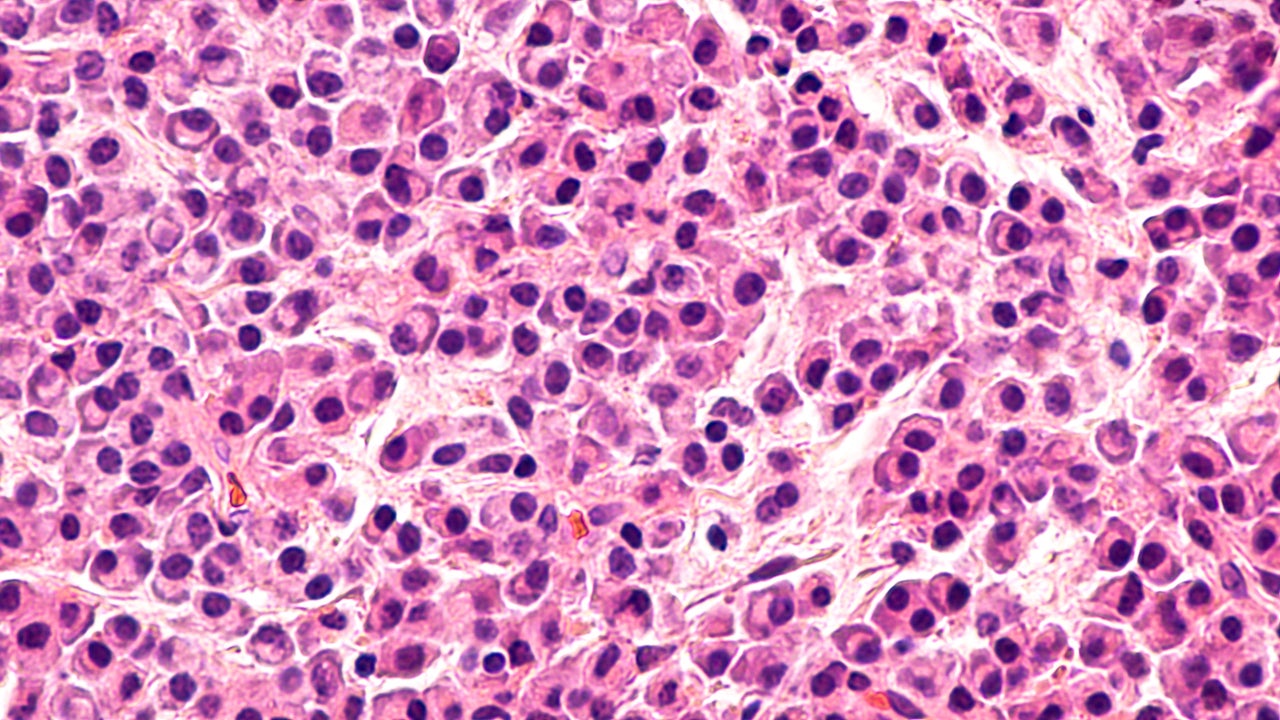

In 1L and 2L, patients would have been prescribed Revlimid, which works by inhibiting angiogenesis, Schjesvold said. Revlimid is in the same therapeutic class as Pomalyst, he added, meaning the use of Pomalyst in 3L and 4L would be recycling the failed therapeutic approach in 1L and 2L. Pomalyst works by enhancing T cells and inhibiting the production of cytokines. Upon Pepaxto’s entry into myeloma cells, it triggers a cellular cascade, leading to DNA damage and causing cell death.

While opinions are split about whether Pepaxto can offer superior efficacy in all patients, the treatment still has the potential to report superior efficacy in EMD patients, experts said. This is based on data from the 157-patient, Phase II HORIZON trial showing Pepaxto delivered a 41% overall response rate in 55 patients with EMD, which is 10 points higher than the 31% seen with Pomalyst and is the trial’s primary endpoint (p=0.002) (Short, K., Leukemia. 2011 Jun;25(6):906–908). ClinicalTrials.gov states HORIZON included patients in the 3L and beyond, although the trial’s recruited patients have a median of five prior lines of therapy.

Pepaxto is a chemotherapy-based therapy, and chemotherapy is generally efficacious against EMD cells because they have lost their dependence on the bone marrow to proliferate, which makes them more sensitive to chemotherapy, Gatt noted. OCEAN does not have inclusion/exclusion criteria related to patients with EMD.

Patients with EMD have large masses of aggressive myeloma outside the bone marrow, Gatt explained. There are currently no efficacious treatments for these patients, Hajek added. Superiority in these patients would be a significant edge for Pepaxto, added Dr Kenneth Anderson, professor, Harvard Medical School, Boston, Massachusetts. Between 7–18% of newly diagnosed MM patients have EMD (Qu, X., BioMed Research International. 2015. 787809). This rate increases the more patients relapse, Anderson added.

Pepaxto has a superior safety profile compared to Pomalyst, which will help the argument Pepaxto use is advantageous, investigators agreed. With Pomalyst, more than 30% of patients have fatigue, dyspnoea, diarrhoea, upper respiratory tract infections, back pain and pyrexia, as per its FDA label.

In contrast, HORIZON data shows the main safety issues with Pepaxto were neutropenia and thrombocytopenia. Although these are Grade ≥3, and so are monitored by clinicians, these issues do not impact a patients’ quality of life dramatically, said Schjesvold. Thrombocytopenia is straightforward to manage via transfusion, Mellqvist noted. In his OCEAN trial patients, there are no concerning toxicity issues, Hajek added.

Noninferiority achievable based on experience in open-label OCEAN

OCEAN’s noninferiority benchmark is more achievable, the five experts said. They also noted noninferiority should be enough for Pepaxto to garner an FDA approval. OCEAN investigators Mellqvist and Hajek said their patients are experiencing comparable efficacy with Pomalyst in the open-label trial. Gatt, who has a total of five patients in OCEAN, said both treatments appear to be noninferior to each other.

The five experts noted OCEAN is likely to report more robust efficacy data than HORIZON, which should be enough to help Pepaxto reach OCEAN’s noninferiority benchmark. HORIZON recruited patients in the later-line setting, who are even harder to treat than 3L and 4L patients, they explained. In HORIZON, Pepaxto reported a PFS of 4.2 months in patients with a median of five prior lines of therapy (Richardson, P., et al., Journal of Clinical Oncology. 2021 Mar 1;39(7):757–767).

If OCEAN reported an increase of 20–30% over the 4.2 months in HORIZON, this would justify the move of Pepaxto in an earlier-line setting, Schjesvold said. However, this benchmark should be even higher at 30–50% due to the shift to an earlier line, Anderson noted.

OCEAN has a secondary endpoint investigating duration of response. OCEAN improving on the 5.5 months found in HORIZON is crucial for patients’ quality of life, said Mellqvist. For Hajek, a median duration of response of 10–11 months would be clearly superior, but based on his OCEAN experience, he expects 7–8 months to be more achievable and still clinically relevant. The duration seen in OCEAN looks to be similar, not better than with Pomalyst, said Gatt. Pomalyst, in combination with low-dose dexamethasone, has a median duration of 8.2 months (Richardson, P., Blood. 2014 Mar 20;123(12):1826–1832.).

While noninferior efficacy is FDA approvable, clinicians would then have to base their judgement on which therapy to use based on safety or administration convenience. While Pepaxto has an edge on safety, Pomalyst has the advantage as a once-daily oral drug for 21 days, Gatt and Hajek said. In contrast, Pepaxto is administered via an IV central line administration route, they added. Unlike a regular IV line, a central line enters a vein near the heart and requires additional monitoring. For Mellqvist, such an IV approach is not a large problem for patients, as their primary concerns will be efficacy and safety over convenience.

Sean Rai-Roche is a Reporter for Clinical Trials Arena parent company GlobalData’s investigative journalism team. A version of this article originally appeared on the Insights module of GlobalData’s Pharmaceutical Intelligence Center. To access more articles like this, visit GlobalData.