The popularity of GLP-1 receptor (GLP-1R) subcutaneous treatments for obesity has proved the demand for the drugs, but the lack of oral alternatives represents a significant (and profitable) gap, according to an analyst at GlobalData.

Pharmaceuticals analyst Jasper Morley said that the race to be first to market is already on, commenting: “With expected drug sales for GLP-1Rs in obesity estimated to surpass $126bn by 2030, this drug category presents a lucrative market for drug developers. Novo Nordisk and Eli Lilly have already reaped substantial rewards in the injectable segment. However, the emergence of oral therapies is reshaping the landscape.”

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

GlobalData is Clinical Trials Arena’s parent company.

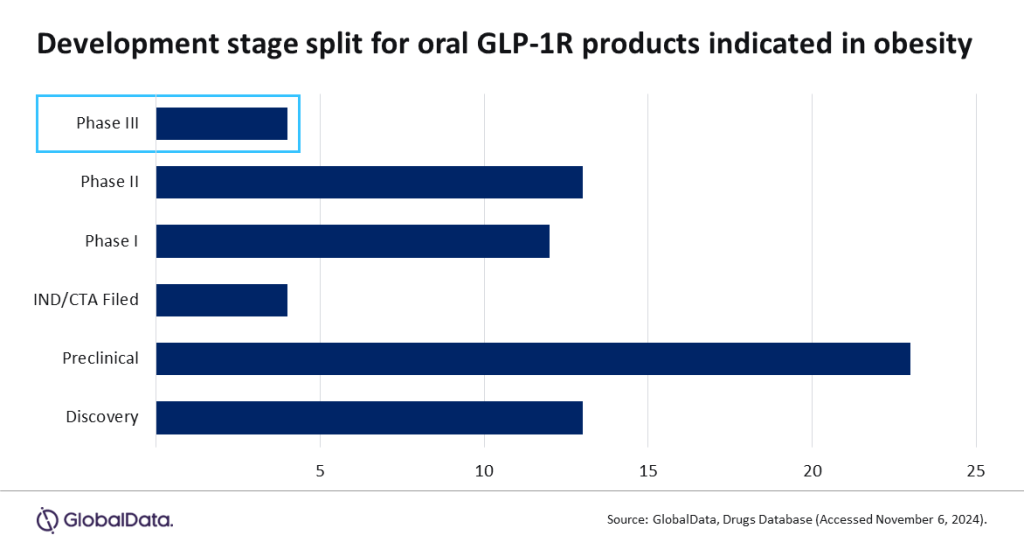

There are currently 63 oral GLP-1R drugs in active development, according to GlobalData’s drugs database. Of these, four products are currently in Phase III.

These include two products by Novo Nordisk, producer of blockbuster drugs Wegovy and Saxenda. One of its Phase III products – Rybelsus – has already received FDA approval for cardiovascular risk factors and type 2 diabetes. Its other obesity-treatment candidate – NN-9932 – is expected to be launched by the end of 2025. It has the highest likelihood of approval among all drugs in this category, at 35%.

Novo Nordisk’s competitor Eli Lilly, producer of Zepbound, is also looking to move into the oral GLP-1R space with its Phase III candidate orforglipron calcium.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMorley explained: “Eli Lilly’s lone Phase III candidate, orforglipron calcium, has two firsts, becoming the initial oral GLP-1R approved for obesity and achieving the first GLP-1R approval for a small molecule. With a projected launch in 2026, it represents Eli Lilly’s bid to expand the company’s dominance in the GLP-1R category.”

The fourth Phase III product is China-based Jiangsu Hengrui’s HRS-953. Produced by a player outside of the pharmaceutical giants who usually dominate the space, it could mark a shake-up of the market offerings. Jiangsu Hengrui’s inroads highlight the appeal of a growing global market and the promise of the competitive oral GLP-1R market.

Morley concluded: “With 63 active products in the pipeline, the race for the first approval is intensifying. Nevertheless, Novo Nordisk and Eli Lilly are positioned at the forefront, striving to capitalise on their already successful GLP-1R portfolios and solidify their dominance in the GLP-1R market.”

The success of GLP-1R-targeting drugs highlights their viability as a treatment approach for obesity, which is defined as excessive fat accumulation. Obesity is endemic in the US, with the New England Journal of Medicine reporting that half of all US adults will be obese by 2030. Around the world, 43% of adults were overweight in 2022 and 16% were living with obesity, according to the World Health Organisation.