In May 2023, pharma giant Eli Lilly looked as if it was onto a winner after publishing positive topline data from the Phase III TRAILBLAZER-ALZ 2 trial of its Alzheimer’s disease candidate donanemab.

The company has since published full data and applied for approval with the US Food and Drug Administration (FDA). Lilly had hoped that the candidate would get the green light by the end of 2023, however in November, the agency asked for more time to review the trial data with a decision expected by the end of Q1 2024.

In March 2024, the agency handed the company another set-back, calling for an advisory committee (AdCom). Lilly announced that the FDA expects to better understand the “efficacy implications of the unique trial design”.

Speaking about the AdCom, Anne White, president of Lilly Neuroscience, said that the big pharma giant remains confident in the candidate’s ability to provide ‘meaningful benefit’ to early Alzheimer’s disease patients.

According to GlobalData analysis, sales of donanemab could hit $5.37bn in 2029, with the global market for Alzheimer's disease set to be worth $13.7bn across the 8MM by 2030. GlobalData is the parent company of Clinical Trials Arena.

Tau enrolment likely to be major talking point

One of the unique aspects of the TRAILBLAZER-ALZ 2 design which the FDA will want to understand better is the patient enrolment process which was determined by tau levels from PET scans.

Not only was tau an important aspect in eligibility, but the data showed that it also correlated with a better outcome says Philippa Salter, senior neurology analyst for GlobalData. As a result, it would be beneficial to understand which patients will benefit most from these treatments given the expense.

The tau enrolment is a favourable aspect of the study design according to Dr. Sarah Banks, neuropsychologist at the University of California, San Diego. In enrolment and efficacy tests for Biogen and Eisai’s Lequembi (lecanemab), trials investigators used verbal memory-based tests in which women tend to perform better. As a result, Banks says this could bias the data. By looking directly at the tau level, Banks says that donanemab did not risk this potential bias.

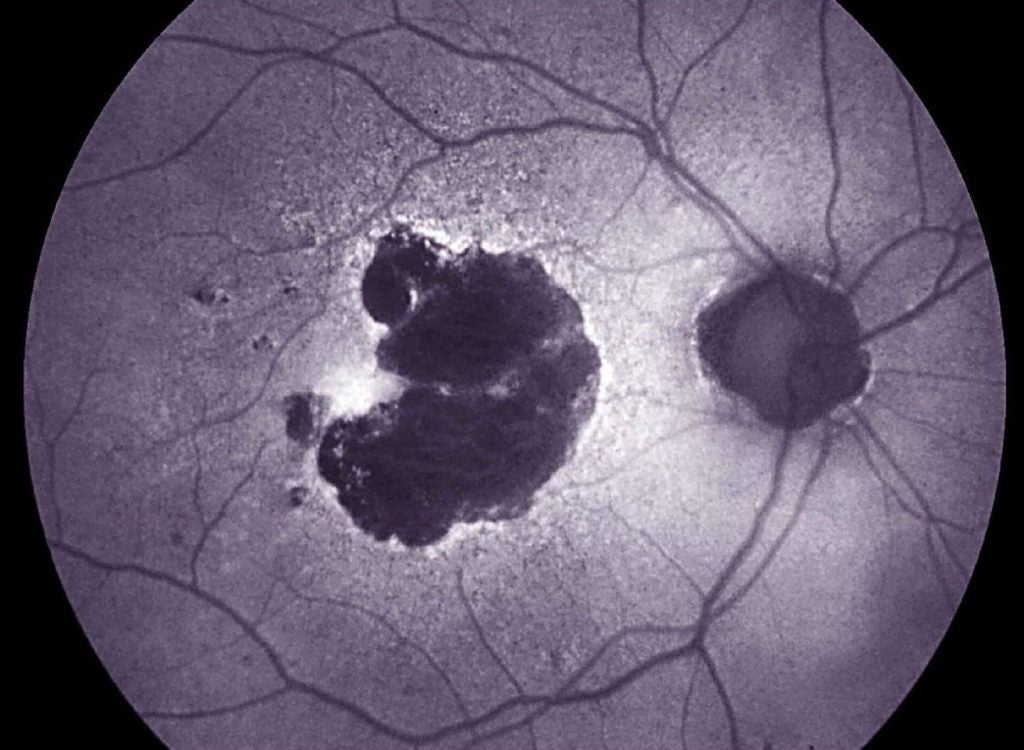

The link with tau goes even further than enrolment and benefit, says Salter, noting it could be linked to amyloid-related imaging abnormality (ARIA) related events, making it an even more important biomarker for the FDA to consider.

“Due to the concerns of ARIA relating to these monoclonal antibodies, the risk-benefit profile is better in patients with low tau where the drug is more effective, compared with patients with higher tau levels,” Salter adds.

Tests to determine these levels are scarcely available however and very expensive, making it a potential barrier unless an alternative method to monitor tau can be used.

“You have to have a PET scanner, a cyclotron and a ligand which binds to tau. There's only one ligand that is FDA approved for clinical use and that is flortaucipir which is what they used in the study but it is difficult to get hold of which is a restriction,” Banks explains.

Dr. Dennis Selkoe, The Vincent and Stella Coates Professor of Neurological Diseases at Harvard Medical School, says that new methods to measure tau are in development including the ptau217 blood test.

“We also don't know about how tau plasma correlates with those scans. The blood test might detect a soluble form that doesn't correlate directly with the deposition of fibrillar tau and tangles,” Selkoe explains.

Selkoe expects that the FDA is going to question how to translate tau evaluation into everyday practice to make it easier to determine eligibility.

ARIA concerns require further monitoring

One of the notable takeaways from Lilly’s trial was the higher ARIA levels, with three ARIA associated trial deaths. ARIA rates for Leqembi were lower which may raise questions for clinicians about which candidate they should use.

“The FDA may want to understand more about whether doctors are going to be likely to prescribe donanemab in the clinic, when it's symptomatic and asymptomatic ARIA rates are about double what they are for the Leqembi,” Selkoe explains.

Patients in Lilly’s trial were closely monitored, with MRIs at four, 12, 24, 52, and 76 weeks as well as the potential for unscheduled MRIs at investigator discretion.

“I think it is likely that there will be the same or similar label requirements with monitoring for donanemab as Leqembi’s label,” says Salter.

Monitoring these levels is especially important in clinic as vascular comorbidity is common in Alzheimer’s disease patients which may exaggerate ARIA risk Banks says.

There are some issues with frequent monitoring however, firstly accessibility to such frequent testing and secondly the cost of these and whether payers are willing to cover that.

“It might be one thing if you're in a very rich suburb of the US, but it might be another thing if you're in a more rural or less resourced area,” Banks explains.

Stopping treatment after improvement

Another unique part of the trial design is that patients were removed from the drug when centiloid levels dropped below 11. In topline data from May 2023, Lilly said that half of patients completed their course of treatment by 12 months.

Although this is unique and, in some ways, controversial compared with donanemab competitors, stopping treatment makes sense when a patient has had full benefit says Banks, who believes this could make it preferable.

“When do you stop Leqembi? Are you on it for the rest of your life? When they were looking at donanemab they seemed to be more realistic. It is an infusion, not a pill that patients can self-administer. Being able to stop treatment is advantageous and translates better to real world,” Banks says.

But questions have been raised about what comes next. “Is that the end of the game for patients with Alzheimer's disease? Does donanemab take care of everything or do clinicians have to think about them coming back for further monitoring and potentially getting other treatments?” Selkoe asks.

This is something the FDA will be considering, especially the question of when to stop as this will need to be incorporated into the label.

Previous approvals will cause the FDA to act with caution

It may be that the FDA is keen to be cautious given that only two drugs with the same mechanism of action (MoA) have previously been approved, and lots of questions remain about the risk-benefit ratio of amyloid removing treatments.

Not only this, but there has been a great deal of controversy around the FDA’s decision to give Aduhelm (aducanumab) accelerated approval in 2021. In January 2024, Biogen decided to hand the rights for the drug back to Switzerland-based Neurimmune to focus efforts on Leqembi.

Whatever it is that the FDA needs clarifying, the timing of the agency’s decision to hold the AdCom just days before a decision was expected is rather unusual and has certainly raised the eyebrows of many specialists in the field.

One thing is for certain – when a date is set, all eyes of the industry will be watching to see how the meeting unfolds.