Swiss biotechnology company Memo Therapeutics has raised Sfr25m ($27.6m) in a Series C financing round led by Pureos Bioventures.

The funding round included contributions from the company's existing investors Red Alpine, GF Group, Fresenius Medical Care Ventures, Verve Ventures, Schroders Capital, Swisscanto, Vesalius Biocapital and Adjuvant Capital.

Memo Therapeutics will use the funding to complete Phase II clinical development of AntiBKV for BK polyomavirus (BKV) infection in renal transplant patients.

AntiBKV is designed to neutralise BKV infection in kidney transplant recipients.

Memo Therapeutics expects Phase II clinical data on the drug next year.

The new funding will also support the company's preparation to increase CMC manufacturing of AntiBKV before its Phase III clinical trial and potential entry into the market.

In addition, Memo Therapeutics will use the proceeds to advance its current antibody pipeline.

Memo Therapeutics board of directors chairman Elias Papatheodorou said: “With these new funds, we are in an optimal position to complete a multi-centre Phase II study with AntiBKV, a treatment option that could dramatically improve the lives of renal transplant patients.

“Importantly, we will also scale up CMC manufacturing of AntiBKV to ensure we have product ready for further clinical evaluation and in anticipation of a potential launch in 2025.

“On behalf of Memo Therapeutics, I’d like to welcome our new investor, Pureos Bioventures. We are also fortunate to have the long-term support of our existing investors who share our goal to develop best-in-class therapeutic antibodies for difficult to treat diseases.”

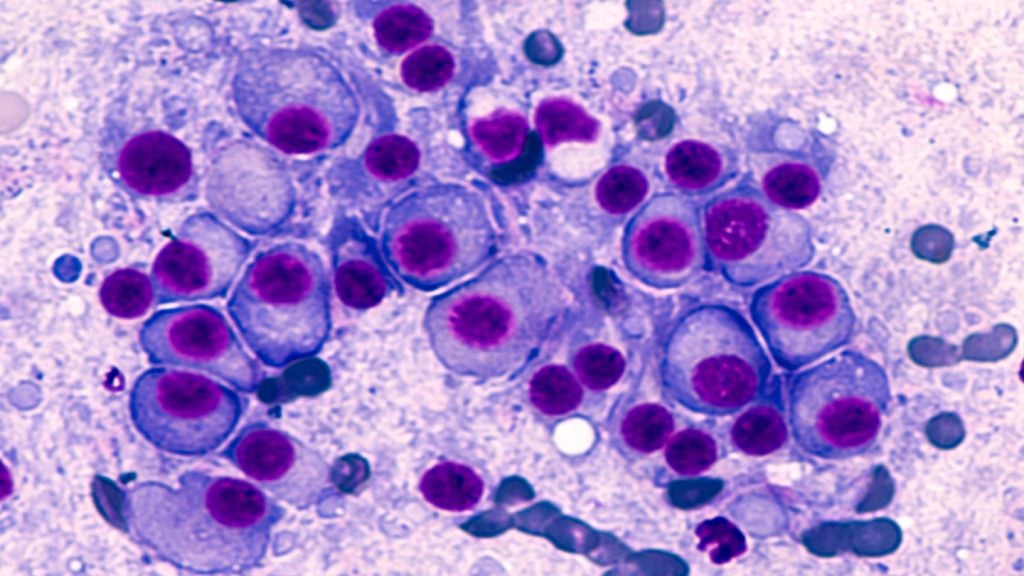

BKV infection poses a substantial risk post-transplantation, leading to severe impacts on graft function and patients' survival.

Earlier this year, Memo Therapeutics began enrolling subjects in a Phase II/III trial of AntiBKV to treat BKV infection in renal transplant patients.

The trial involves administering four 1,000mg doses of AntiBKV every four weeks to participants against a placebo.