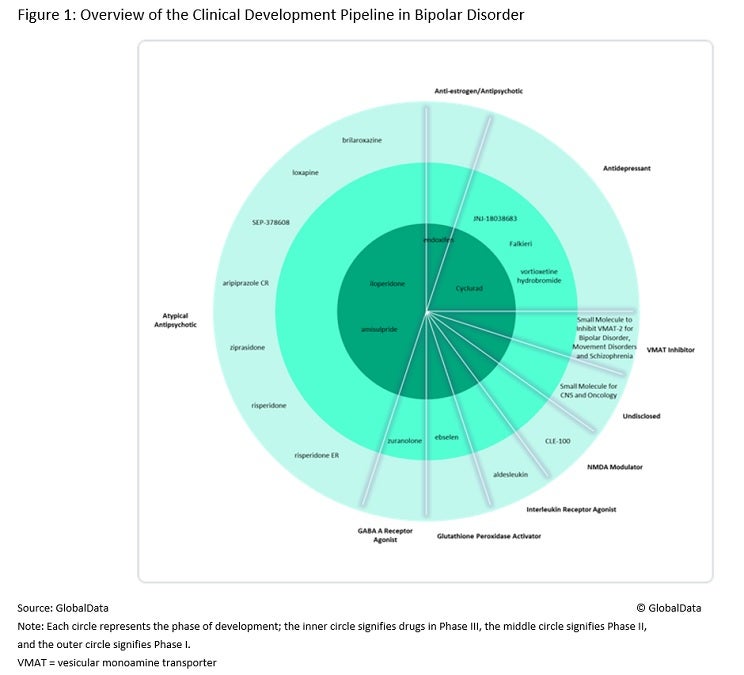

The bipolar disorder pipeline is moderate in size, with agents in a range of different drug classes. It includes both agents that target bipolar mania and agents that target bipolar depression, as well as more niche patient populations such as treatment-resistant bipolar depression. Figure 1 (above) summarises the pipeline agents in clinical development for bipolar disorder across the eight major markets (8MM), namely the US, the five major European markets (5EU – France, Germany, Italy, Spain and the UK), Japan and Canada.

The atypical antipsychotics have a strong presence in the bipolar disorder pipeline, despite the presence of 13 atypical antipsychotic products, as well as generics, already being on the market for managing acute manic symptoms. Pipeline agents will therefore need to demonstrate significant advantages over currently available products to best compete in the market, a point emphasised by key opinion leaders (KOLs) interviewed by GlobalData. One way these agents can differentiate themselves is through their safety profiles, as the marketed atypical antipsychotics are associated with effects on metabolic parameters (such as weight gain, hyperglycaemia and dyslipidaemia) and extrapyramidal symptoms (dystonia, akathisia, Parkinsonism and tardive dyskinesia).

KOLs agreed that despite intense competition, space remains in the bipolar disorder market for atypical antipsychotics with significantly improved safety profiles. Even with improvements in safety, the lack of novelty in this approach means that new atypical antipsychotics are likely to result only in incremental advances in treatment efficacy, especially for products that are reformulations of existing drugs, such as risperidone extended release (ER) and aripiprazole controlled release (CR), both of which are in Phase I development.

Beyond the atypical antipsychotics, there are a variety of novel mechanisms of action (MoAs) in the bipolar disorder pipeline that developers are hoping will offer improved efficacy and safety compared with available products. These new MoAs provide a point of difference for developers looking to enter this competitive market, and they may also be used to target new patient sub-populations in which competition is lower. For example, if they reach the market, Celon Pharma’s Falkieri (esketamine) would become the first approved treatment for treatment-resistant bipolar depression, while NRX Pharmaceuticals’s Cyclurad (cycloserine + lurasidone) would become the first approved treatment for acute suicidal ideation or behaviour associated with bipolar depression. There is a high unmet need for effective treatments for bipolar depression, and suicide rates are higher in bipolar disorder patients than in the general population, so these are important patient populations to be targeting.

GlobalData anticipates that six products in the late-stage pipeline will enter the bipolar disorder market prior to 2030. These products are BioXcel Therapeutics’ dexmedetomidine, Vanda Pharmaceuticals’ Fanapt (iloperidone), Jina Pharmaceuticals’ endoxifen, Cyclurad, Sunovion Pharmaceuticals’ SEP-4199 (amisulpride), and Falkieri. In addition, Intra-Cellular Therapies’ Caplyta (lumateperone) received US Food and Drug Administration (FDA) approval for the treatment of depressive episodes associated with bipolar I or II disorder last month and is expected to launch later this year.

Although there are several promising agents in the pipeline, it is unlikely that lithium will be replaced as the gold standard treatment for bipolar disorder, given its efficacy in treating both bipolar mania and bipolar depression, as well as the fact that it is effective for both acute and maintenance therapy. It is also unlikely that these agents will alter the treatment paradigm. It is more likely that they will become supplementary options that can be added to existing treatments or used when more established therapies fail.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData