Big Pharma Boosts AI Collaborations for Drug Discovery

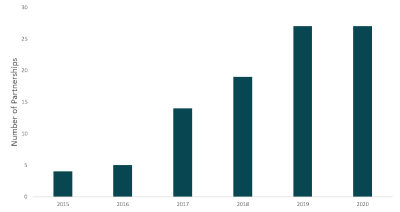

The pharmaceutical industry is under increasing pressure, with rising costs of research and development (R&D) eroding profit margins. The entire process of developing a drug from preclinical research to marketing can take 12–18 years and often costs between $2.0–3.0B, with only about 10% of candidates successfully completing clinical trials and gaining regulatory approval. Artificial intelligence (AI) has the potential to transform drug discovery by rapidly accelerating the R&D timeline, making drug development cheaper and faster and improving the probability of approval. AI can also increase the effectiveness of drug repurposing research. Almost 100 partnerships have been identified between AI vendors and Big Pharma companies since 2015, with increasing numbers witnessed in recent years. GlobalData analysis shows that there were four partnerships for AI-based drug discovery forged by Big Pharma in 2015. In 2020, 27 partnerships in this field were identified, an increase of 575% in just six years (Figure 1).

Figure 1: The number of Big Pharma AI partnerships has risen significantly since 2015.

Source: GlobalData Pharmaceutical Intelligence Center, Accessed December 2020.

Examples of leading AI vendors operating in the drug discovery space include Exscientia, Atomwise, Recursion Pharma, Iktos, Insilico Medicine, Sensyne Health, and BenevolentAI. For Big Pharma, Pfizer, Takeda, and AstraZeneca lead the way in terms of the number of partnerships, with eight deals identified for each company. Other pharmaceutical companies that have recently forged deals in this area include Novartis, Bristol Myers Squibb (BMS), Roche, Janssen, Merck KGaA, Boehringer Ingelheim, Bayer, GSK, and Sanofi.

One early example involves Sumitomo Dainippon Pharma, which entered into a research alliance with Exscientia in September 2014 that led to the discovery of DSP-1181. The deal involved combining Sumitomo Dainippon’s experience and knowledge in monoamine G protein-coupled receptor (GPCR) drug discovery with Exscientia’s Centaur Chemist AI platform with the aim of discovering novel, multi-target small molecules that fulfilled a demand for selectivity and development criteria and had the potential to deliver enhanced therapeutic performance in the treatment of psychiatric diseases. The exploratory research phase for DSP-1181 took less than 12 months to complete, a fraction of the 4.5 years needed on average by conventional research techniques. According to Exscientia’s estimates, this decrease cut the cost of drug development by more than 30%. Fewer than 400 compounds were needed to be synthesised to identify molecules that matched the required development criteria. DSP-1181 entered a Phase I clinical trial in January 2020 for the treatment of obsessive-compulsive disorder (OCD).

Other more recent examples of partnerships include a January 2020 collaboration between Pfizer and Insilico Medicine to use the latter’s machine learning (ML) technology and proprietary Pandomics Discovery Platform to help identify targets and biomarkers that could assist in discovery programs, and lead to therapeutics for patients with unmet medical needs. Also, in January 2020, Recursion Pharma announced that in less than 18 months, its collaboration with Takeda in rare diseases had resulted in the evaluation of preclinical and clinical molecules in over 60 unique indications, with new therapeutic candidates identified for more than six diseases. In October 2020, BMS signed a research collaboration with Sensyne Health that will initially focus on applying Sensyne’s proprietary ML to conduct research into disease progression and patient stratification within the broader group of myeloproliferative neoplasms.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCovid-19 has hastened the adoption of AI in drug discovery and repurposing and could be a tipping point for the widespread adoption of the technology across the pharmaceutical industry. For example, in February 2020, Eli Lilly’s Olumiant (baricitinib) was identified by UK-based start-up BenevolentAI as having the potential to treat Covid-19 and received Emergency Use Authorisation (EUA) by the FDA in November. It took BenevolentAI just three days to identify six promising approved drugs for the treatment of Covid-19. Similarly, in June 2020, Repurpose.AI announced a collaboration with Scripps Research to leverage its ActivPred AI Drug Discovery Platform to discover drug candidates to treat Covid-19. In July 2020, AI Therapeutics launched a Phase II clinical trial of LAM-002A (apilimod dimesylate) to treat newly diagnosed Covid-19 patients, a repurposed drug discovered through AI technology.

In general, compared to other industries, pharma has been slow to adopt AI, but evidence has shown increased activity over the past few years with this trend expected to continue as the benefits of the technology are realised. As well as R&D, AI can be used across a wide range of other functions, allowing for improved clinical trial design and recruitment, smarter and more efficient supply chains, and targeted sales and marketing. While the industry has typically relied on AI vendors for expertise, many companies are also setting up their own in-house capabilities. GSK was an early pioneer in this field, setting up an in-house AI unit in 2017, with other companies like Novartis, Roche, and Bayer following suit. The importance of AI to the pharmaceutical industry was highlighted in GlobalData’s recent Digital Transformation and Emerging Technology in the Healthcare Industry survey, where respondents indicated that AI would be a key area of investment over the next two years and will also be the leading disrupting technology.